Whither the markets & global economy?

Speculation, w(h)etted finger to the wind, and tea leaves.

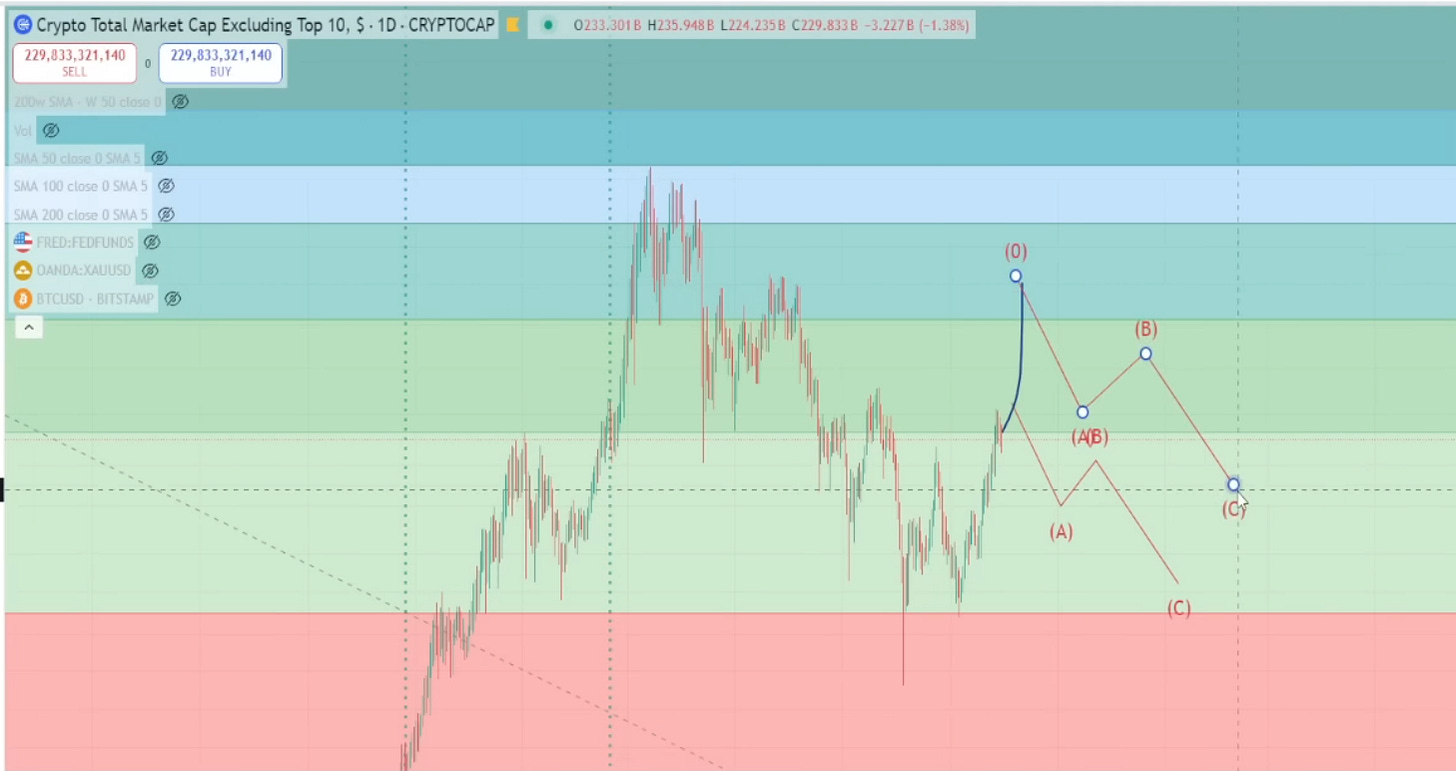

tl;dr Breadth breakout seems [likely eventually, if not] imminent. Caution will be warranted for potential rug-pulls along the way up to full expansion for the crypto token markets.

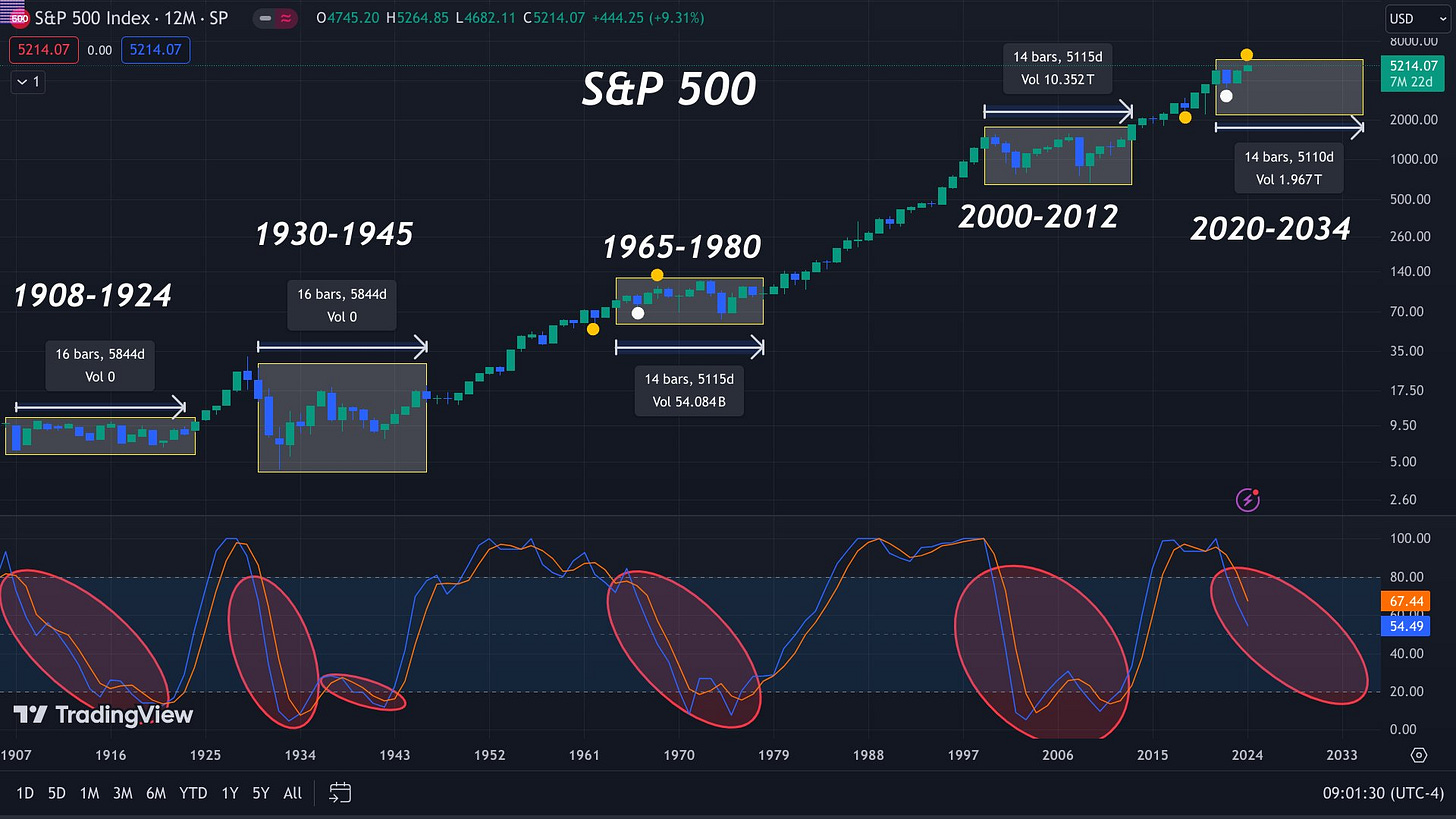

Camel (“it’s your boy”) Finance expects the base case of a “lost decade” deflationary recession and decline, after a final blow-off top.

He/she/it/non-binary-doodadoggle (doodaggle?) bases that expectation on the past repeating ~14-to-16 years of sideways chop following a cross down below the 80 threshold on the twelve-month stochastic RSI chart.

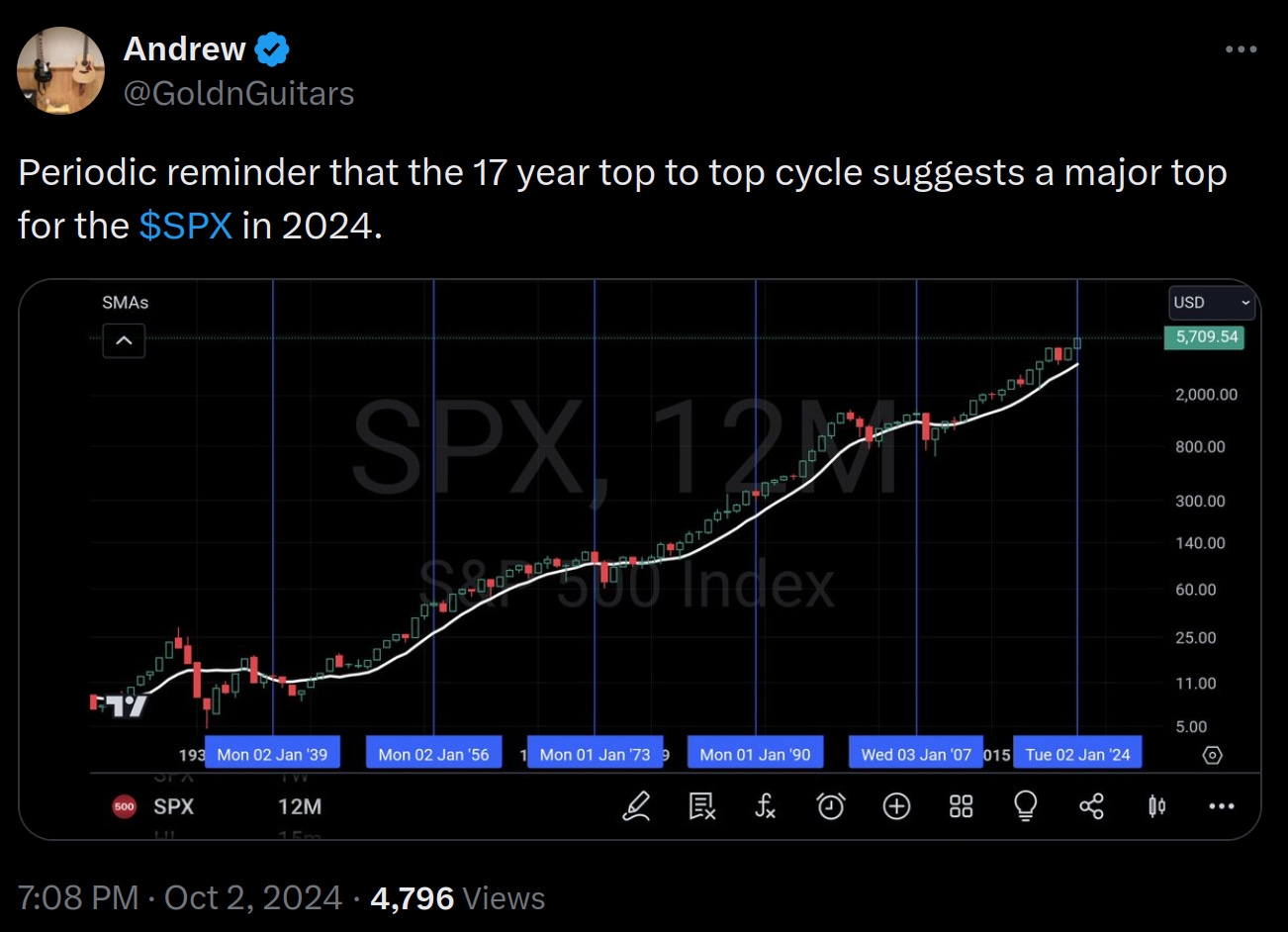

And on a posited 17-year S&P 500 cycle.

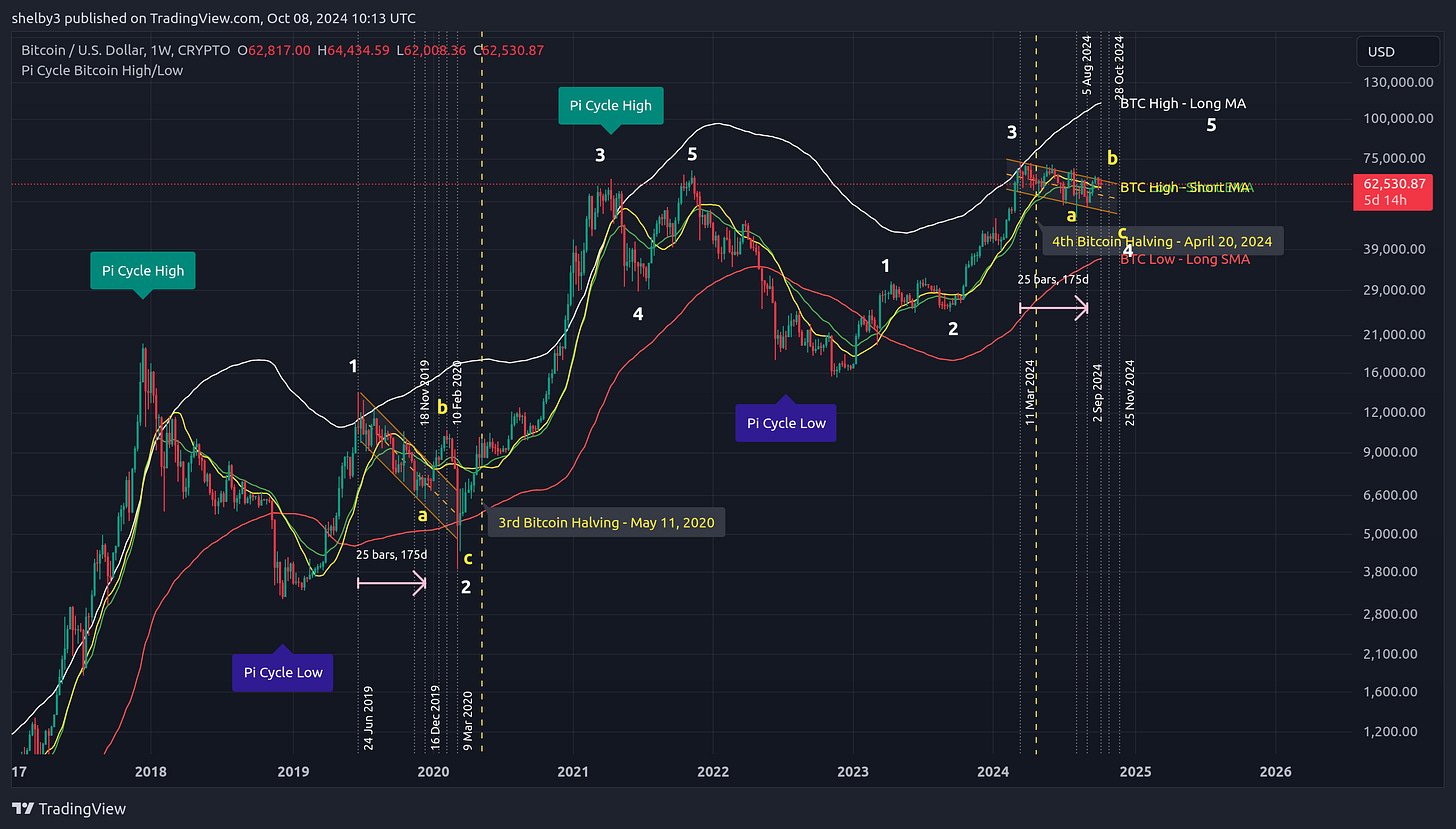

Pi Cycle?

Over the remainder of the decade, could the S&P 500 could make significantly higher-highs and significant crashes, if the mid-1960s to early-1970s is repeating?

The “lost decade” only occurred in the prior instances (i.e. 1907, 1929, 2000) when the year of the breach below said 80 threshold marked the top of the market. Whereas, the 1962-5 and 2022 breaches were not the top of the market.

Additionally one could posit a longer ~30+ (but not 80) year cycle between the twelve-month stochastic RSI low and the next significant market top, which wouldn’t be due for a top until perhaps 2028 to 2032.

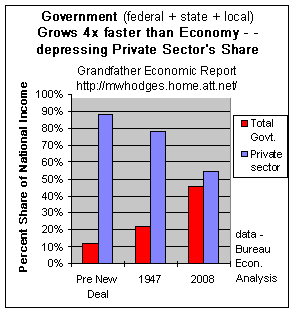

Massive fiscal+monetary stimulus wasn’t possible in 1907 and 1929 being on the gold standard with small government.

It wasn’t until the 2008 Great Financial Crisis (GFC) that (remember Hank Paulson) the lingering vestiges of monetary and fiscal discipline were discarded.

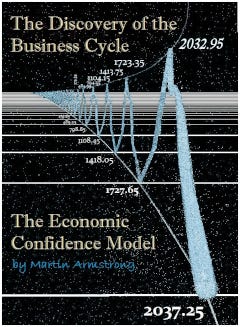

The posited ~30+ year cycle (~2×17, 10×Pi, 4×8.6=4×Pi×1000days) corresponded to four cycles:

The recovery post-Civil War culminating in the financial bubble due to all the world’s capital flowing into the United States of America after the political-economic chaos and devastation of WWI and it’s aftermath.

The recovery from the Great Depression and WWII, as FDR pivoted from the fiscal constraints of the gold-standard to big government (socialism), personal income tax and debt-slavery. Culminating with abrogation of a precious metals backed dollar and (credit to Harry S. Dent) the stagflation of inability to productively employ the bulge of Boomers entering their prime earning and spending age.

The recovery enabled by starting from very high interest rates after Paul Volcker, surge in Boomer productivity, savings, investment and the ensuing fall of the Iron Curtain peace dividend with the opening of the former communist side of the world to capitalism. Culminating with the Internet “dot.com” bubble and the introduction of the Euro—a causal factor in the Asian crisis and Long-term Capital Mgmt fiasco. There was massive underlying natural stimulus (i.e. no deflationary pressures) and the capital markets had to adapt.

The recovery from the GFC globalism-expansionary capital shocks of #3 (analogous but much broader in scope than the Western Boomers coming of age in the 1960s and 70s) into unapologetic/unadulterated/pedal-to-the-metal maladapted mercantile/unbalanced globalism-on-’roids, ZIRP/MMT central banking, Western fiscal dominance, rise of Bitcoin as the 1989 Economist Magazine’s cover story Phoenix, Anglo-Saxon empire Thucydides trap, Western empire Communist-Fascist devolution—to culminate in the 2033 peak in the Economic Confidence Model and some dystopian/utopian sixth wave of six waves of six waves (6×6×6×8.6 year).

The point (which Camel scoffs at) being the prevent-deflation-at-any-cost (i.e. retain control at any cost) imperative. Additionally, the kleptocracy only retains power by funding all vampire squid tentacles of itself, c.f. also 1, 2, 3, 4, 5, 6, 7, 8, 9, 10. The power of that corrupt fiscal dominance, MMT central banking devolution-paradigm doesn’t end in 2025. It ends in 2028 more or less[1] when Bitcoin forces it so and because central planning always fails with much collateral damage. An extended deflationary spiral might cause them to lose control/power. Besides they’re grooming the consumer to be dependent on cashless UBI “stimi-checks”—not warlordism—the global economic predicament is really that dichotomous and has the political/technocrat elite squeezed in a vise.

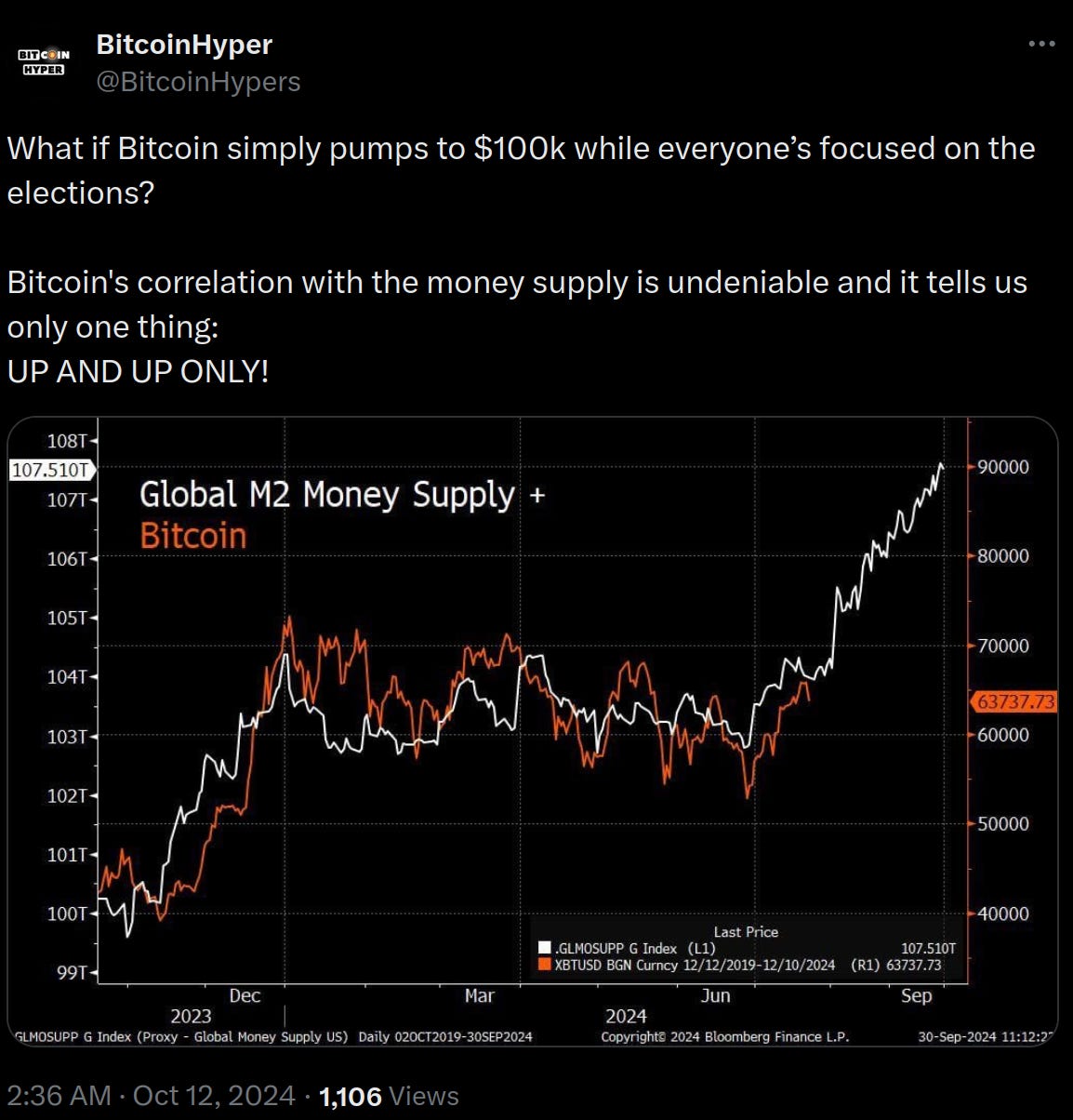

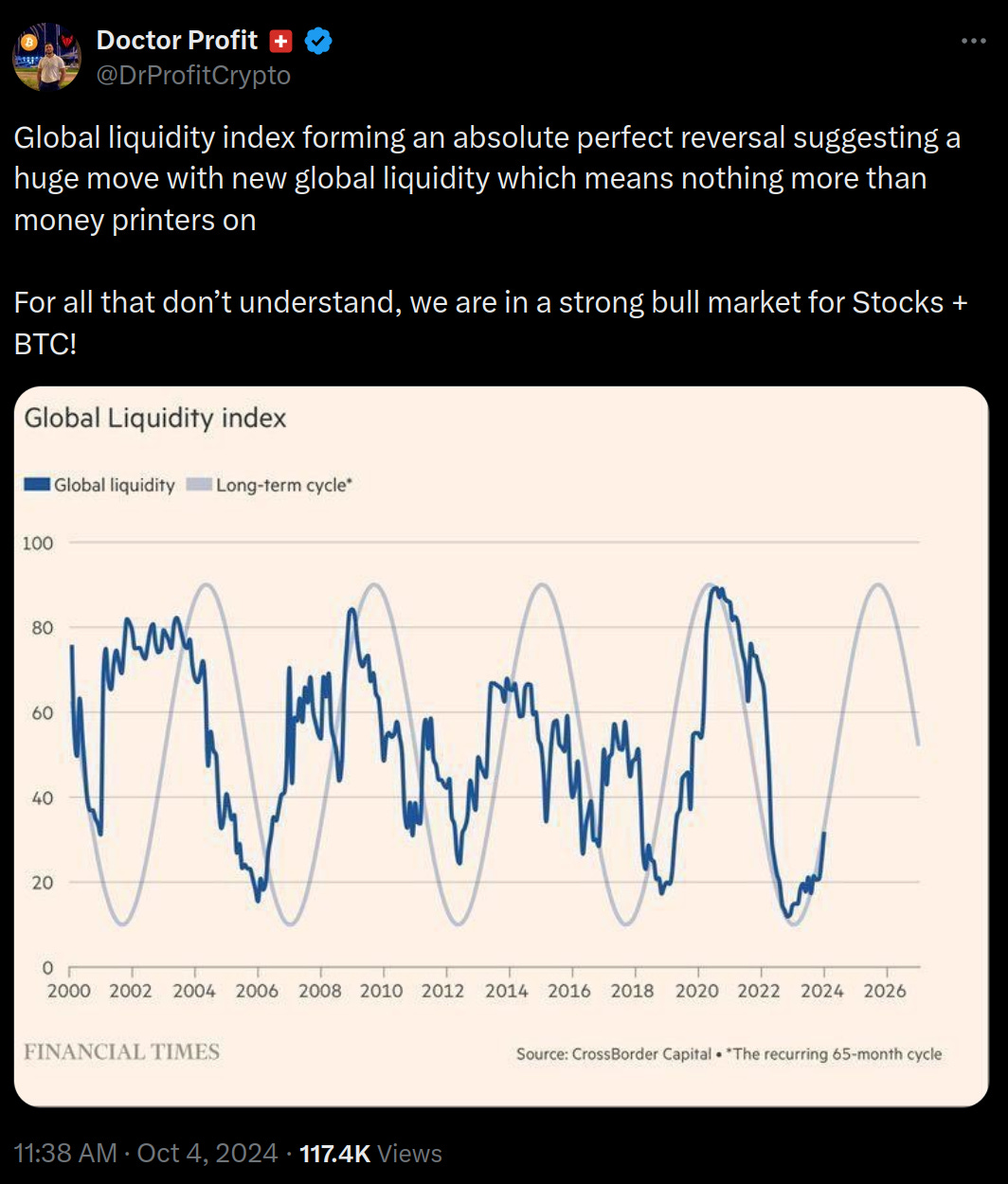

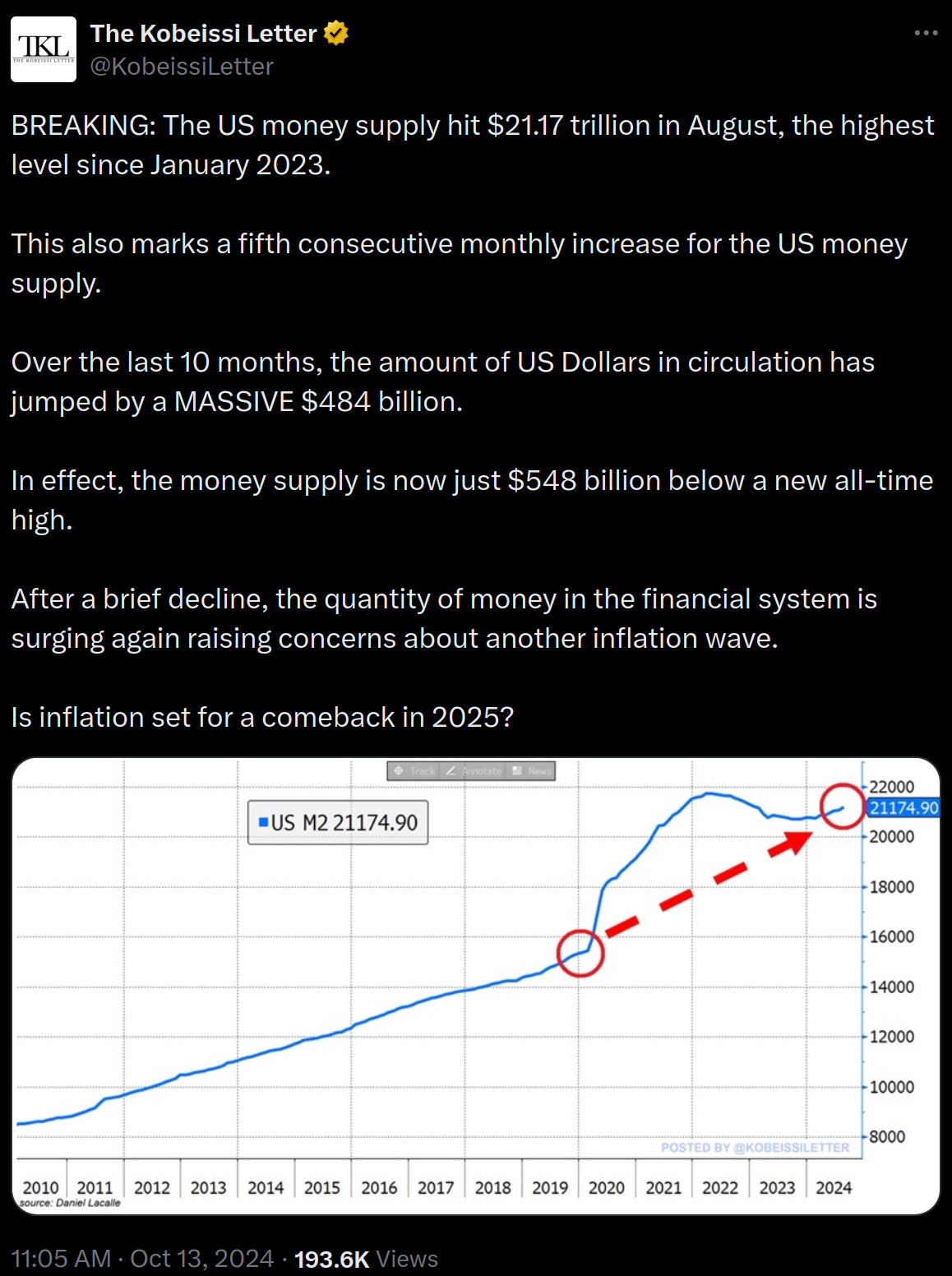

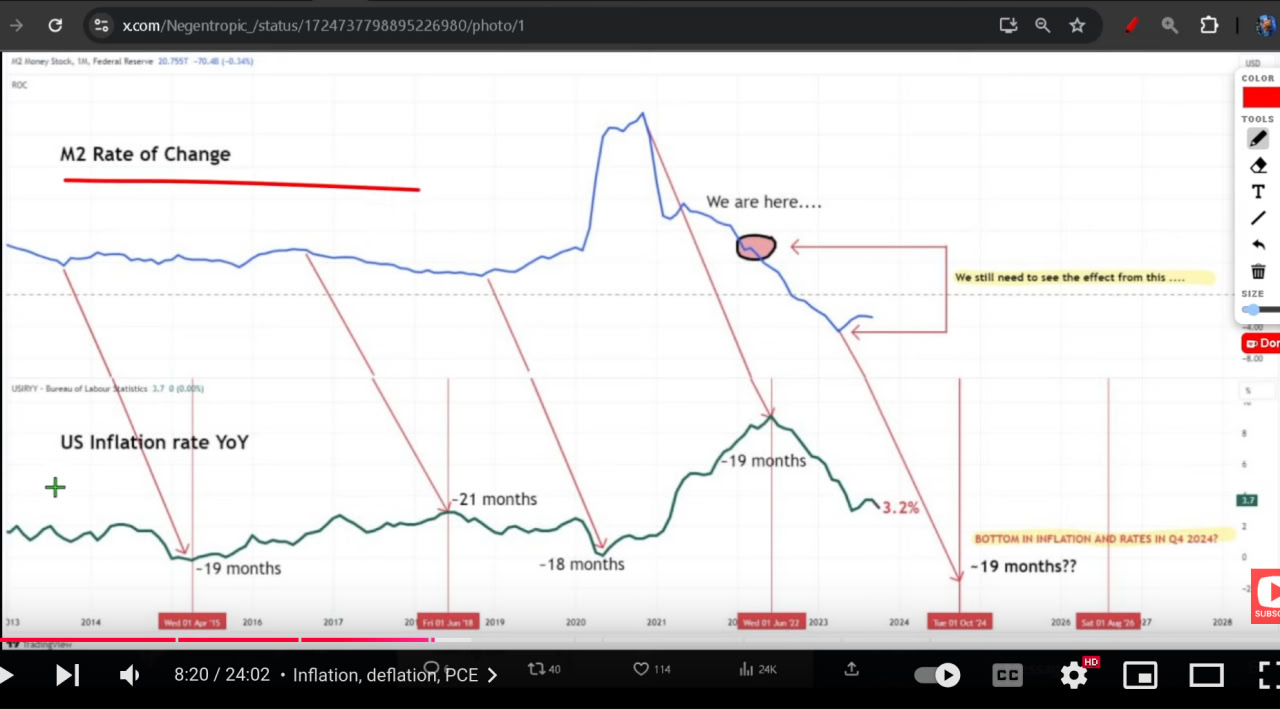

Camel reasons (in his critique of the following tw[x]eet aka x-post) that because (re-)inflation follows M2 money supply growth (or more generally stated various forms of stealth liquidity injections aka ‘net liquidity’) on a significant lag perhaps typically approximately eighteen (18) months. And thus secular bull market must top, followed by a twelve-to-eighteen month secular bear market. He simultaneously admits that excess liquidity can show up in assets, before the recessionary crash drags everything down. But 2020 demonstrated that recessions can be (given a suitable exigent emergency crisis for the excuse or pretext) reflated with excess liquidity within a few months by dropping helicopter money (i.e. stimulus checks) directly into consumer’s pockets. Granted there was the added stimulus of reopening the economy that had been forceably closed—which didn’t reopen as fast a pent-up consumer demand did, thus perhaps exacerbating inflation. There is not some systemic debt contagion/non-performing loans (NPLs) problem with non-commercial real estate like there was in 2008 for the GFC. Merely that the consumer is tapped out and the overall (global, not domestic and/or sector-specific) Minsky Moment wants an unrelenting deflation conflagration scorched earth (i.e. the entire global economy would have to be unwound). So unlike for the 2008 GFC which did have a $trillions misallocation and debt in the housing sector with a global economy capable of resetting without a Minksy Moment collapse into scorched earth collapse of government into warlordism, this time around there’s no possibility nor non-scorched earth future in waiting eighteen months for a non-existent housing misallocation to be unwound—heck most houses are being purchased with cash now thus there’s no debt bubble in housing. Instead merely need to and must drop money into consumers’ bank accounts so the economy will reflate quickly albeit short-lived until the Minsky Moment wants to unwind again. This decade is the end game of the global order—all chips on the table otherwise there no tomorrow. Thus I expect a recessionary crash (significant correction) but for new highs to be made in 2025 after a correction.

If Camel was correct that they’re more worried about the USD losing status (thus prefer not to monetize more USD fiscal debt), then why did they choose a strategy of entrapping Russia in Ukraine, so they could ban Russia from SWIFT, force Russia dependently into China’s arms?

There’s different echelons of power involved. The Neocons and various statal powers are chickens running around with their heads cut off trying to retain control with the engines ablaze. Whereas, the creator of Bitcoin (that old money power 200 IQ Chris Langan refers to) is massaging the chessboard towards their world government end game hinged to their diabolical two-tiered Bitcoin monetary reset (circa ~2028) supplanting the dollar and enslaving the nation-states as implied by the unashamedly bizarre mathematician John Nash in his §Currencies in Competition.[2]

That supreme power facilitated (i.e. the rise of the Neocons, Communism, etc) for us to hate and thus deprecate our kleptocratic nation-states in favor of our supreme masters’ looming Antichrist system.

[1] CTO LARSSON “not a ‘cypherpunk’ rebel” et al, I warned y’all multiple times.

[2]

John Nash’s Ideal Money manifesto advocated accessibility for global citizens as an arbitrage against profligate nation-state fiats. In 2015 Nash was VERY SUSPICIOUSLY (c.f also, also, also, also, also) and opportunistically ejected in a fiery taxi cab crash [on the ‘EZ Pass’ Nash forebode in his Ideal Money paper]. Nash explained that gold isn’t Ideal Money. Whereas, ₿itcoin was clearly designed to be a diabolical continuance of the two-tiered system of the U.S. dollar with even more dire implications with the end of physical cash… — posted Feb 5, 2022

“We got a very good look at that taxi Nash was riding in. It looked like it had been firebombed. I don't know how the driver of that taxi survived.” — post

Differences from 2007

Even our boy Camel has not ruled out a 2007 crash (followed by a GFC) repeat given numerous similarities (including eerie exactly corresponding dates for certain key recent events). Will inflation turn back up again? Game of Trades enumerates some of the key differences thus far, such as currently no skyrocketing oil prices, inflation declining and the advance/decline line in bullish mode.

Alessio Rastani also mentioned the advance/decline as well as the McClellan Summation Index breadth indicator.

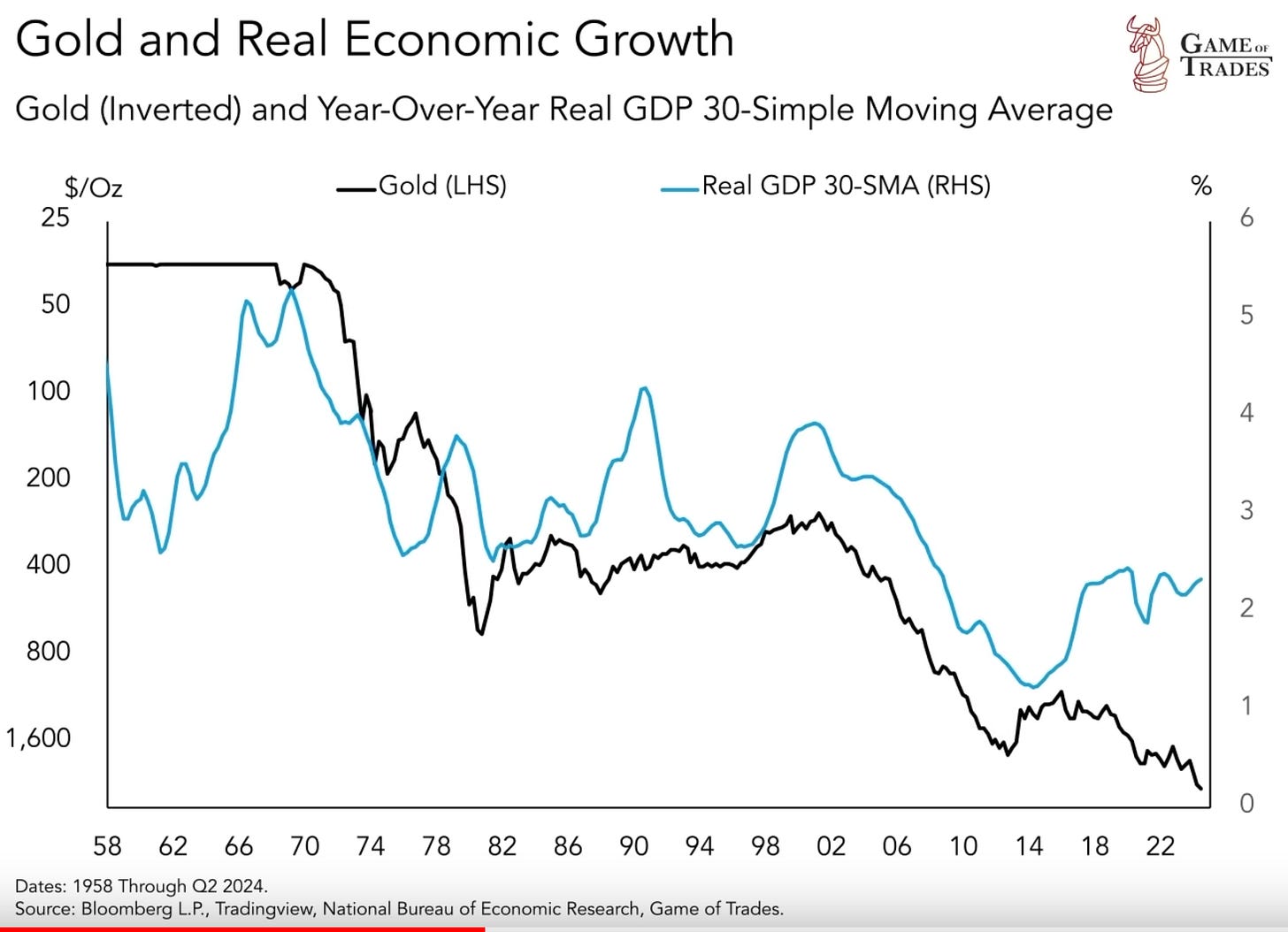

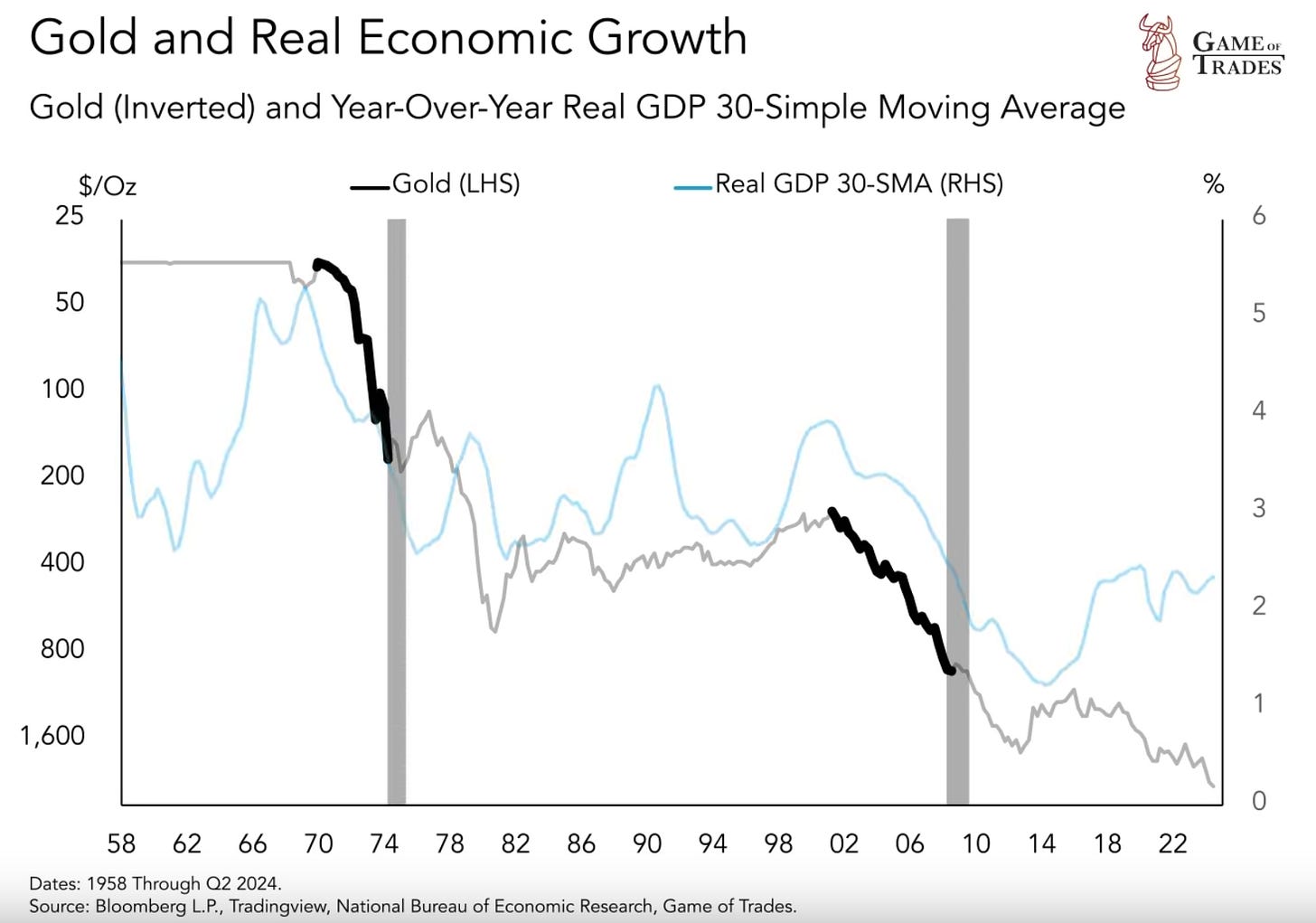

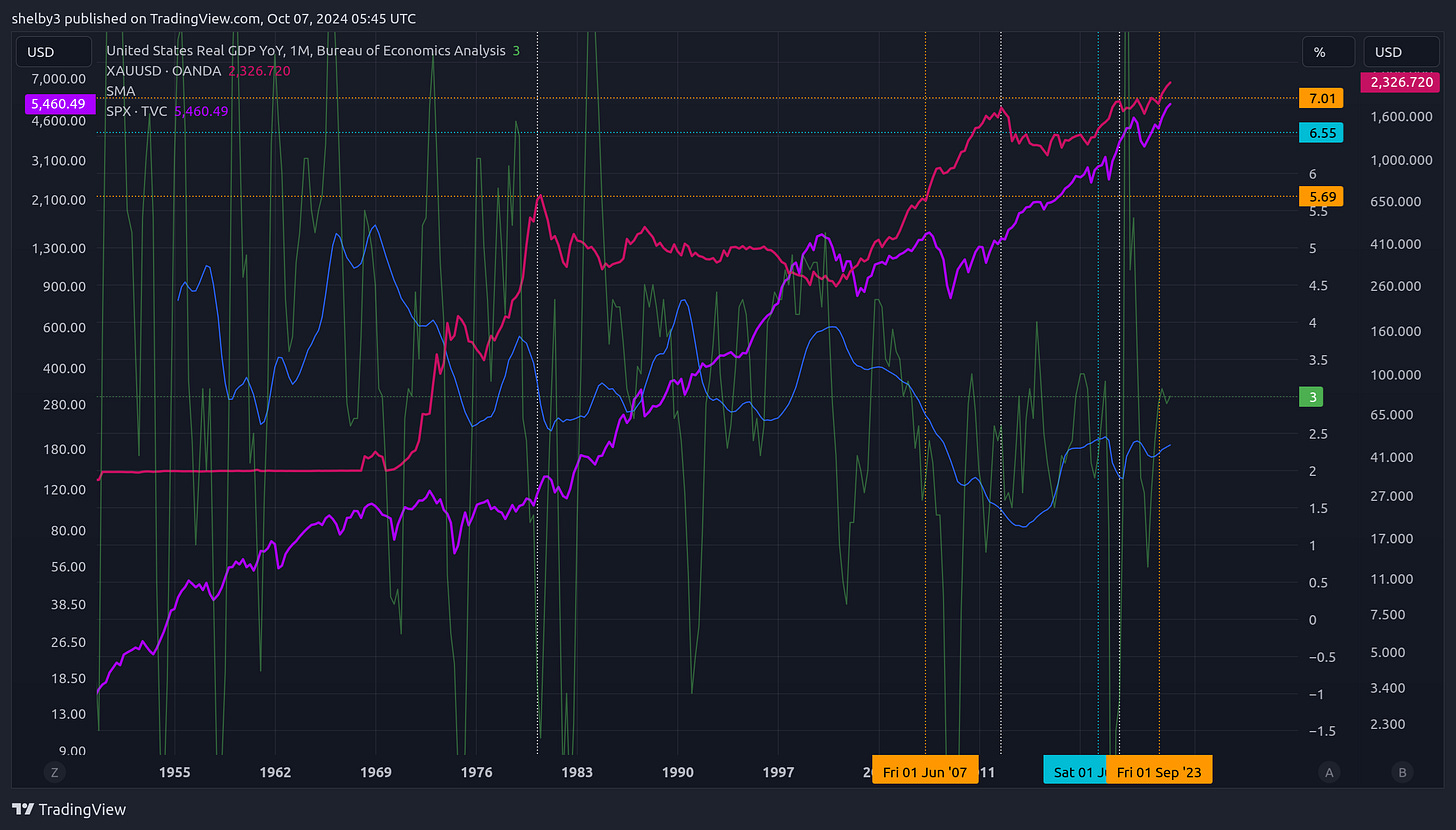

Gold & YoY US Real GDP

What is gold signaling? Bravos Research (formerly Game of Trades) pointed out that gold (inversely) tracks the smoothed three-month SMA of the YoY change in US Real GDP.

Stock market tends to top out when gold bottoms or most especially when gold breaks out above its prior all-time-high. Gold tends to form a new uptrend coincident with a new secular downtrend (eventually to a new all-time-low) in the YoY US Real GDP smoothed 30 SMA. Conversely, stocks tend to start an uptrend when gold tops out.

Analogous to the 1960s, smoothed real GDP has not started a new downtrend, unless perhaps the price index deflator is manipulated by understating actual inflation. Yet gold after initially dropping as the smoothed, real YoY GDP was rising, has since ~2016 diverged from the past correlation— recently even breaking out to a new all-time-high.

If inflation statistics are manipulated now (i.e. thus if smoothed, real YoY GDP is already in a new secular downtrend either because inflation is understated or nominal GDP is overstated, e.g. by including government workers in a fiscal dominance regime, c.f. also), note the gold price was fixed (thus manipulated by decree) in the 1960s as well. Thus if in the 1960s the stock market was rising making higher all-time-highs along with an implicit increase in the value of gold evident by demand voraciously sucking up all and exceeding the supply at the decreed price, would stocks do the same now instead of a “lost decade” — fostered in both cases by government manipulation of the underlying economic reality by borrowing from the future? Even the breadth of the stock market has been dismal since gold broke out. Thus in the 1960s the aforementioned implicit rise in the gold “price” was a harbinger of a looming “lost decade” commencing a few to several years hence. And today the rise of the gold price with the aforementioned government manipulation may be a comparable harbinger.

Clearly that price fixing manipulation started to crumble in 1968 to 1971 as first the London gold pool failed in 1968, US stopped minting 90% silver coinage in 1969 and Nixon was forced to close the gold convertibility window in 1971.

On the prior chart and before crashing, the S&P 500 also followed gold up from March 1968 to March 1969 and again from 1970 to 1973.

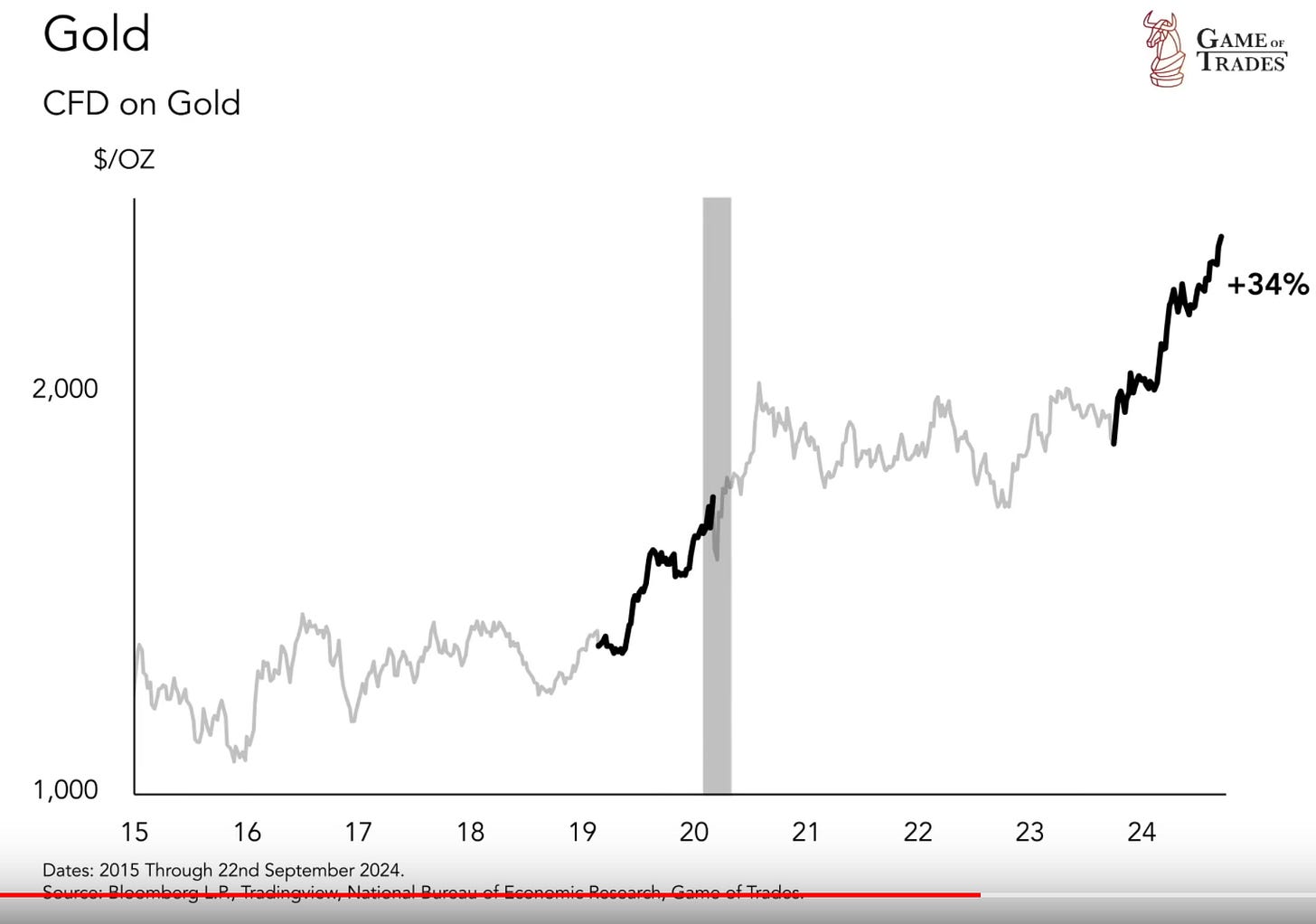

Illustrated below, the March 2020 S&P 500 flash crash followed after gold broke up from its horizontal resistance in March 2019 with stonks in tow up. Is that repeating now with flash crash looming later in this Q4? I wonder what “event”[3] could cause💥 a flash crash this time around? 😲

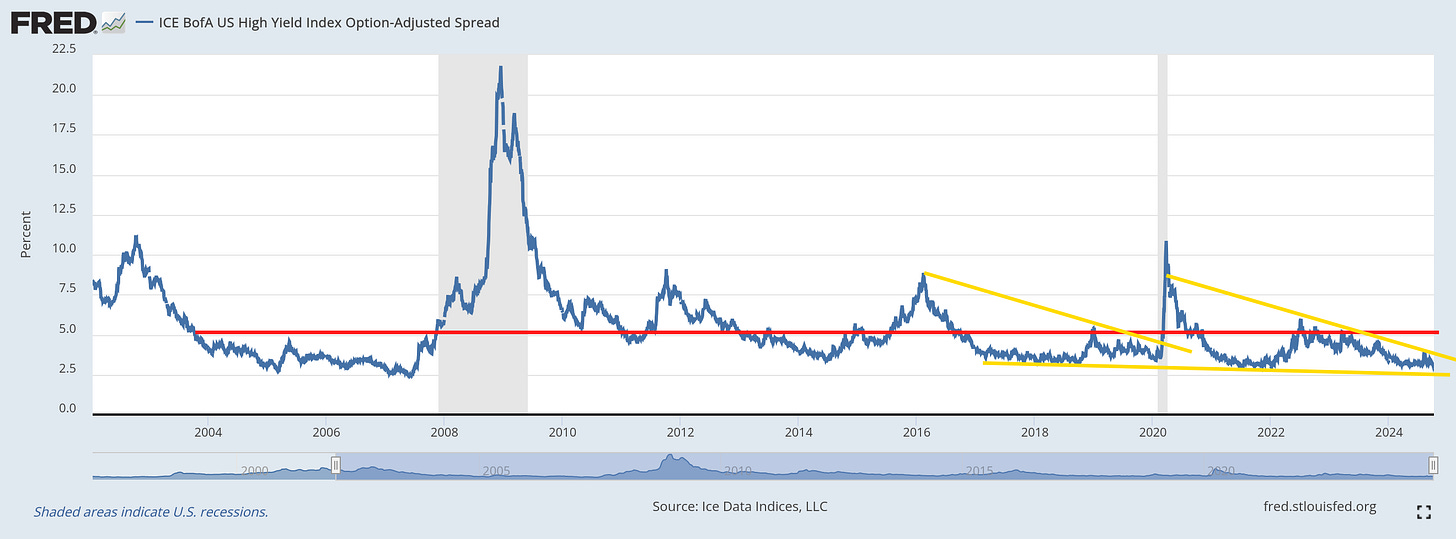

Camel points out that high-yield, risk spreads are compressing again as they did right before the Certificate Of Vassal IDentity crash.

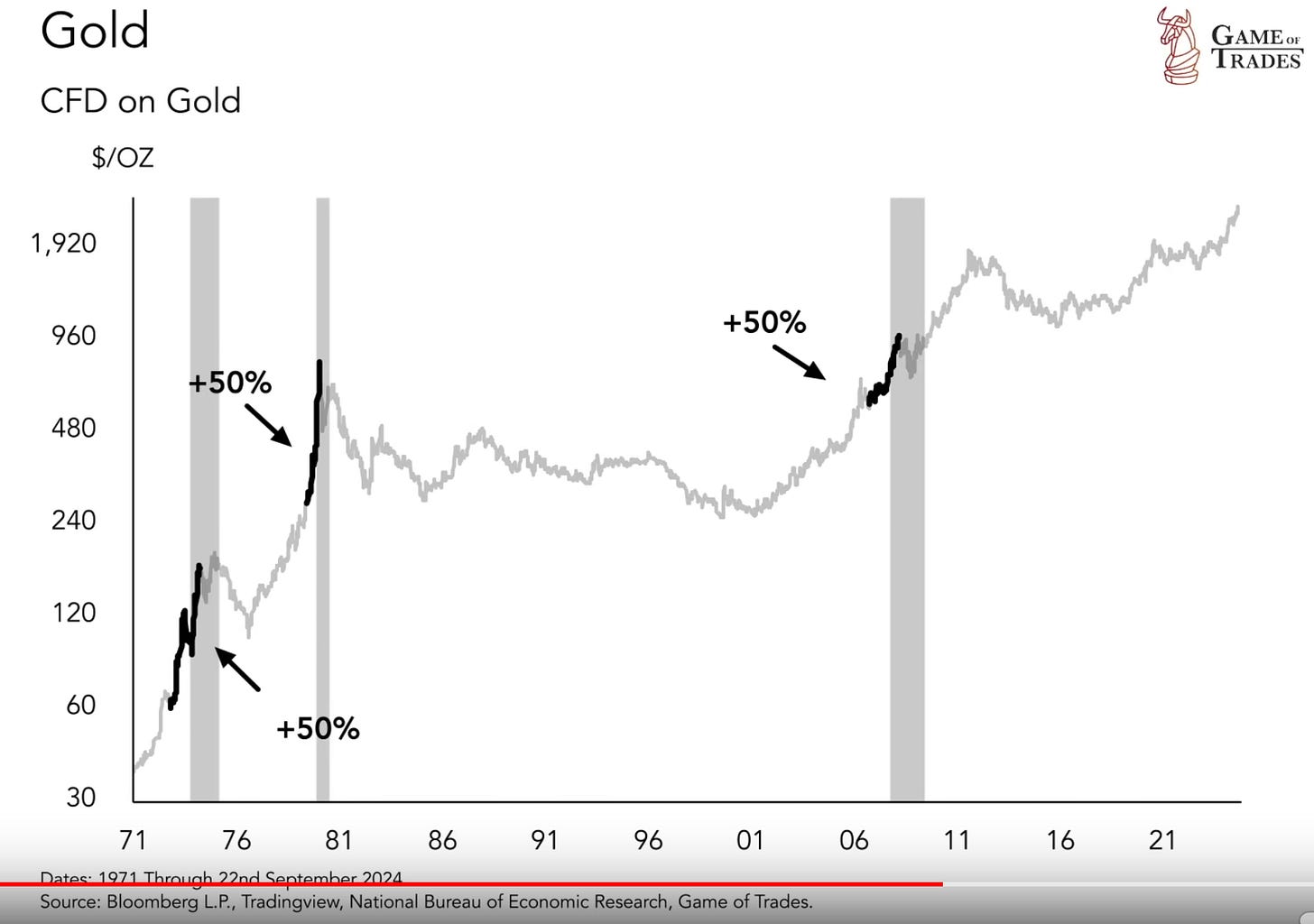

Game of Trades posits that gold rises in anticipation of looming economic problems which governments will be forced to react to with stimulus. Well gold was sniffing that out—in 2019 a year in advance and—before the severe 1974 and 2008 recessions.

GoT highlights that the breakout signal on gold is not as extreme as it was for the major recessions of 1974, 1980 and 2008.

But is comparable in magnitude to the signal leading into the 2020 recession.

8:20 Camel if inflation bottoms in the next month or two, and if that marked the vertical rise in M2 in summer 2020, then why wouldn’t stonks and Bitcoin be back up at new ATHs 6 to 9 months later same as for 2021?

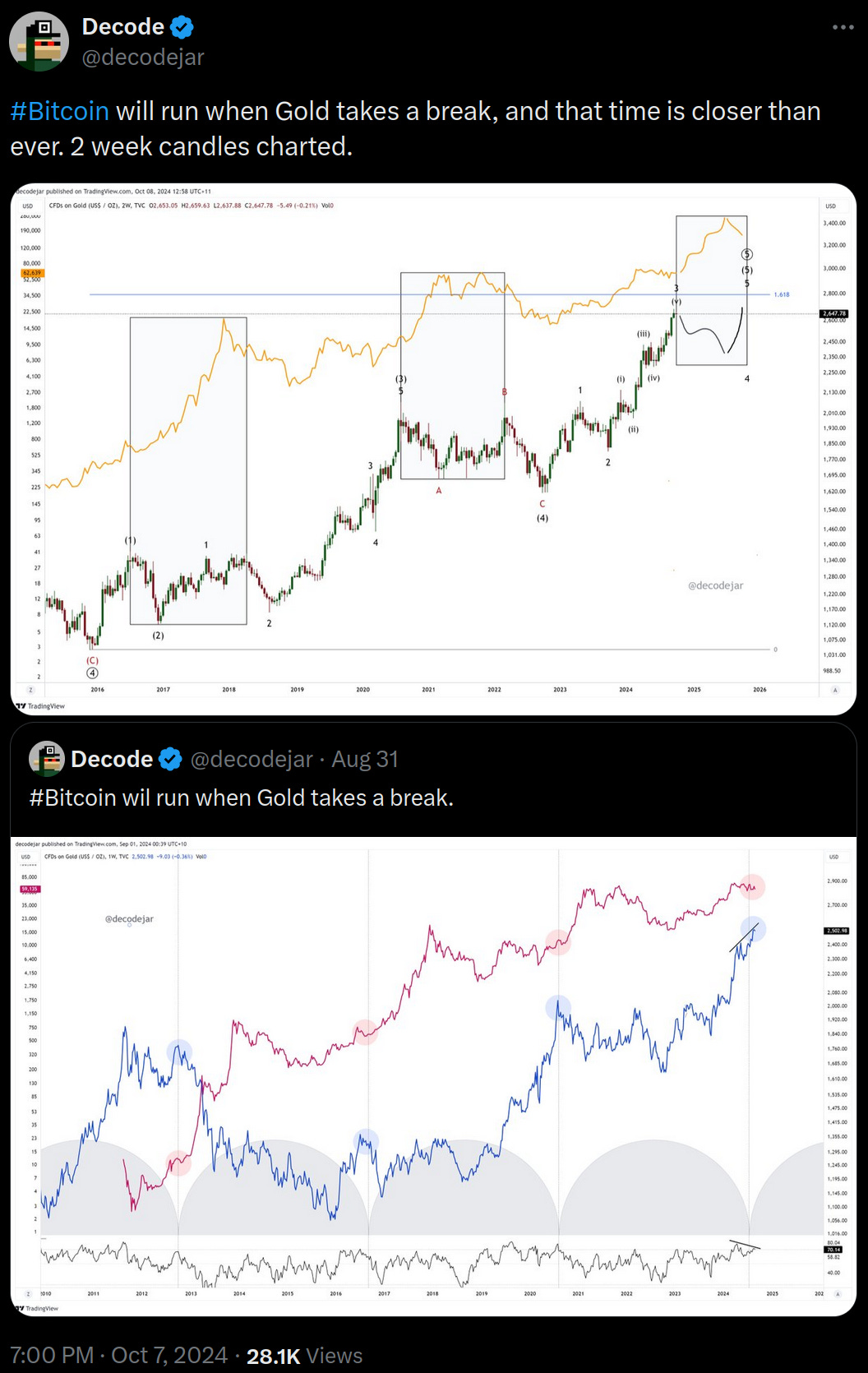

The reason for the delay in reflation of recessions is when there is a contagion in the debt-financed sector such as housing for the 2008 GFC, which requires a long lead-time to recover because everyone has to go through the round-trip of contraction and defaults to reset pricing and sentiment before banks start lending again. But this is entirely not the situation now. The government and Fed can flip on the helicopter money as they did in 2020 given a suitable crisis excuse to do so. Bitcoin always goes into its 6 to 9 month final bull rally parabola phase after gold tops, which gold ostensibly just did. Gold breaking out can be a harbinger or a imminent flash crash as was case in 2020 or the manipulation to prevent the gold breakout signal (by decree in 1960s) or stonks rising with the gold breakout to new ATHs due to manipulation and low breadth can be a harbinger of a lost decade that is delayed by several years by the government control over the economy (e.g. by decree in 1960s and currently with fiscal dominance and Treasury+Fed doing yield curve control manipulations along with the reverse repos).

As for your repeated hubris about how you got everything correct, even a broken analog wall flower clock is correct twice a day. I would prefer some greater sophistication and depth to your research instead of the monotonous repetition of the same points over and over and over.

Repeating the Q4 2019 thru Q1 2020 script?

The waning liquidity injection from the now distant Bank Term Funding Program (BTFP aka “buy the f-ing pivot”†), Bitcoin ETF launch and Fed pause, has parched the languishing breadth of the markets. Year 2022 was the first time interest rates were being hiked into a bear market. Will there be enough juice to drive a sustained breadth rally just from the Fed cutting late and the market’s sudden realization/shock that inflation is plummeting towards or below the Fed’s 2% target?

† btw, that “banking system collapse” was precipitated by another kleptocracy crime scene.

Analogous to Q4 2019 as the Fed was finally capitulating from too hawkish whilst there were global financial stresses compressing (c.f. also), requiring some event[3] to drive a flood of needed new liquidity concomitant with feeding the tentacles of the aforementioned vampire squid. Even Camel acknowledges the sideways-to-down channel pause since March seems too drawn out in time to be a bull flag.

Consider Camel’s unease and urgency (and the cycles support) if a 28 October 2024 top seems unbelievably too accelerated.

Why does Camel cling to his hypothesis for a Bitcoin blow-off top followed by a 24-month bear market, instead of considering the eerie parallels to Q4 2019? Bitcoin hasn’t been able to keep up with breadth-less stonks since March— ditto after June 2019 (S&P was still moving up while Bitcorn was down).

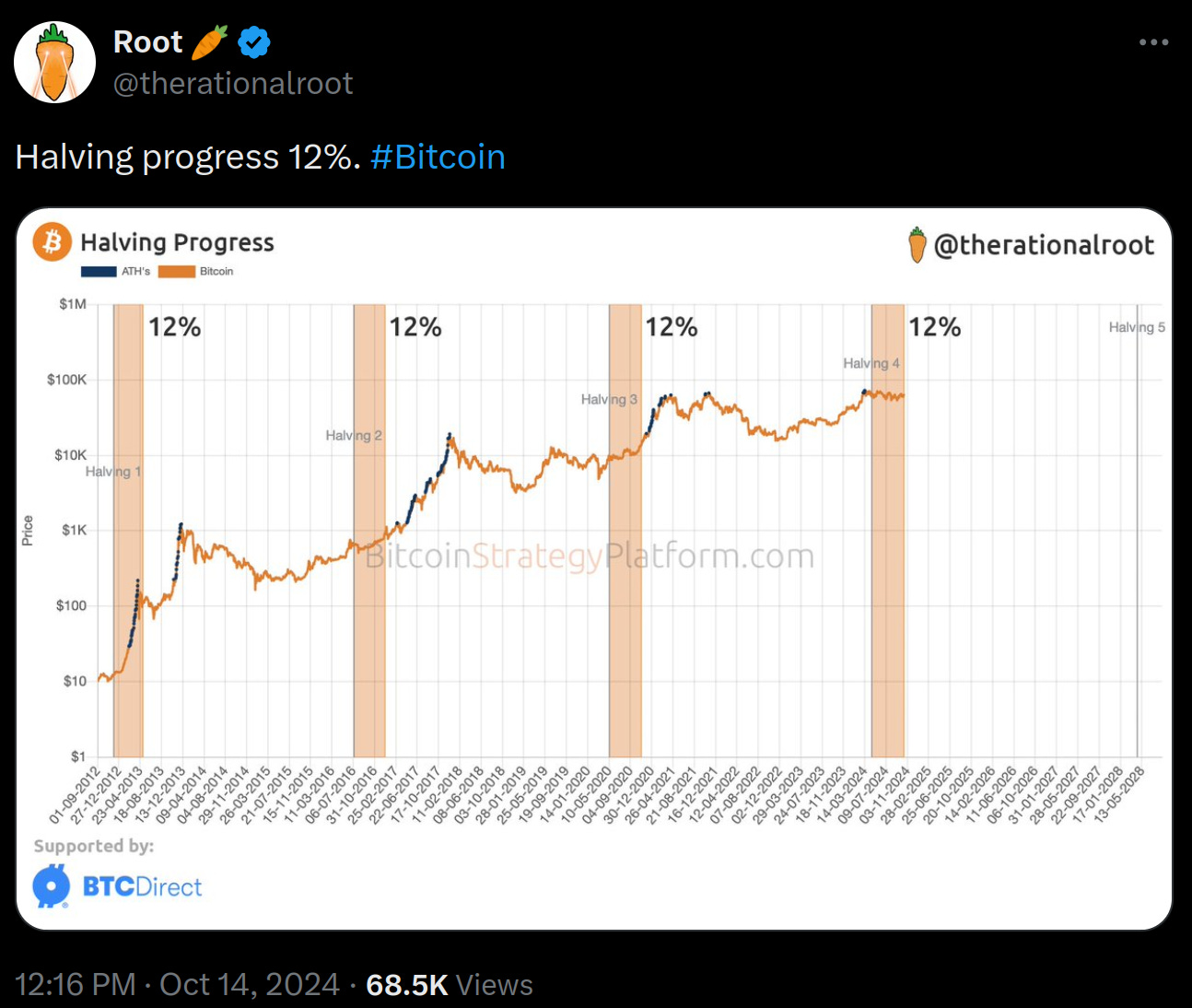

Well Camels could argue (or spit out as they tend to do) that it’s post-halving already unlike from Q4 2019 through Q1 2020.

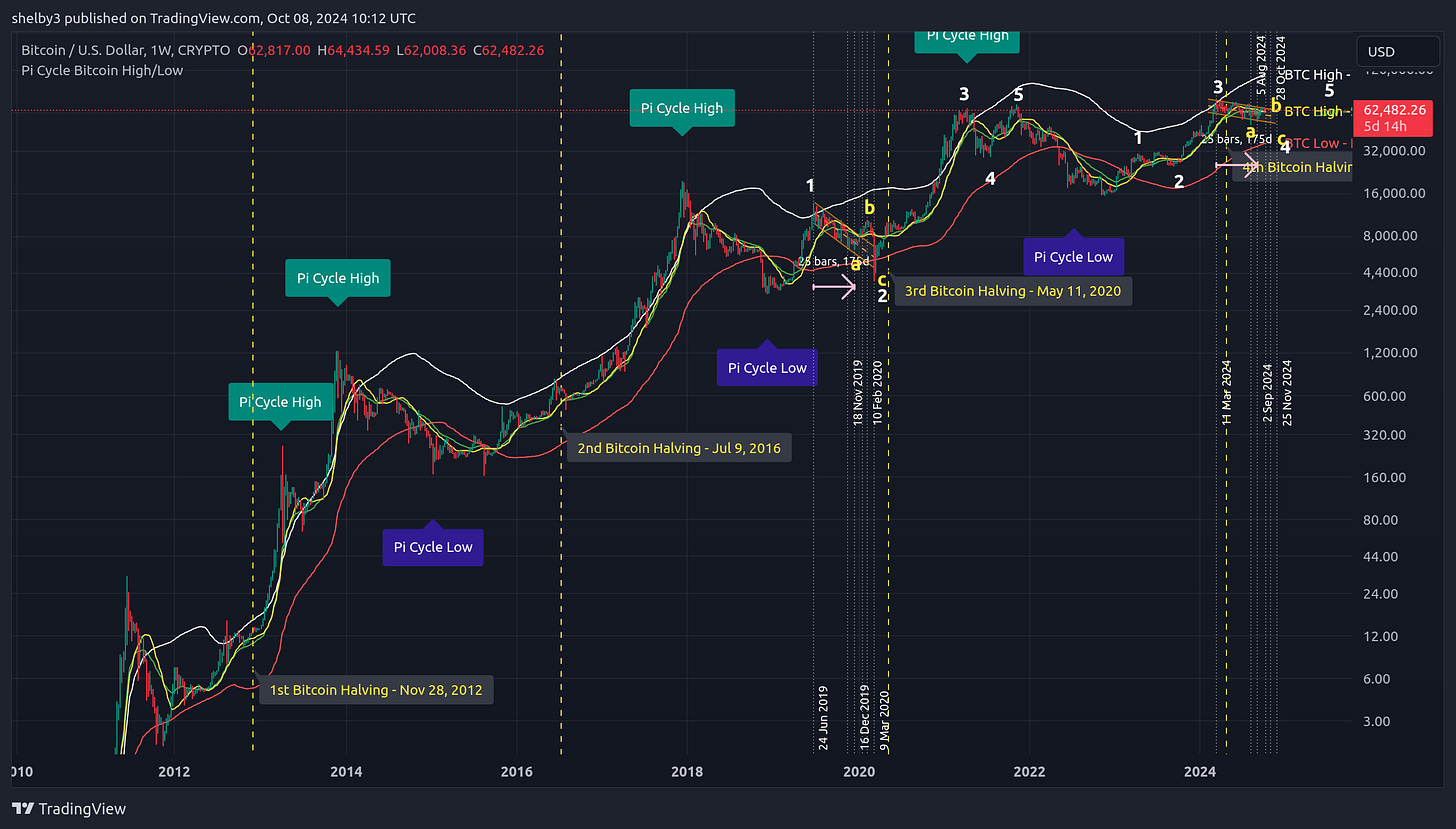

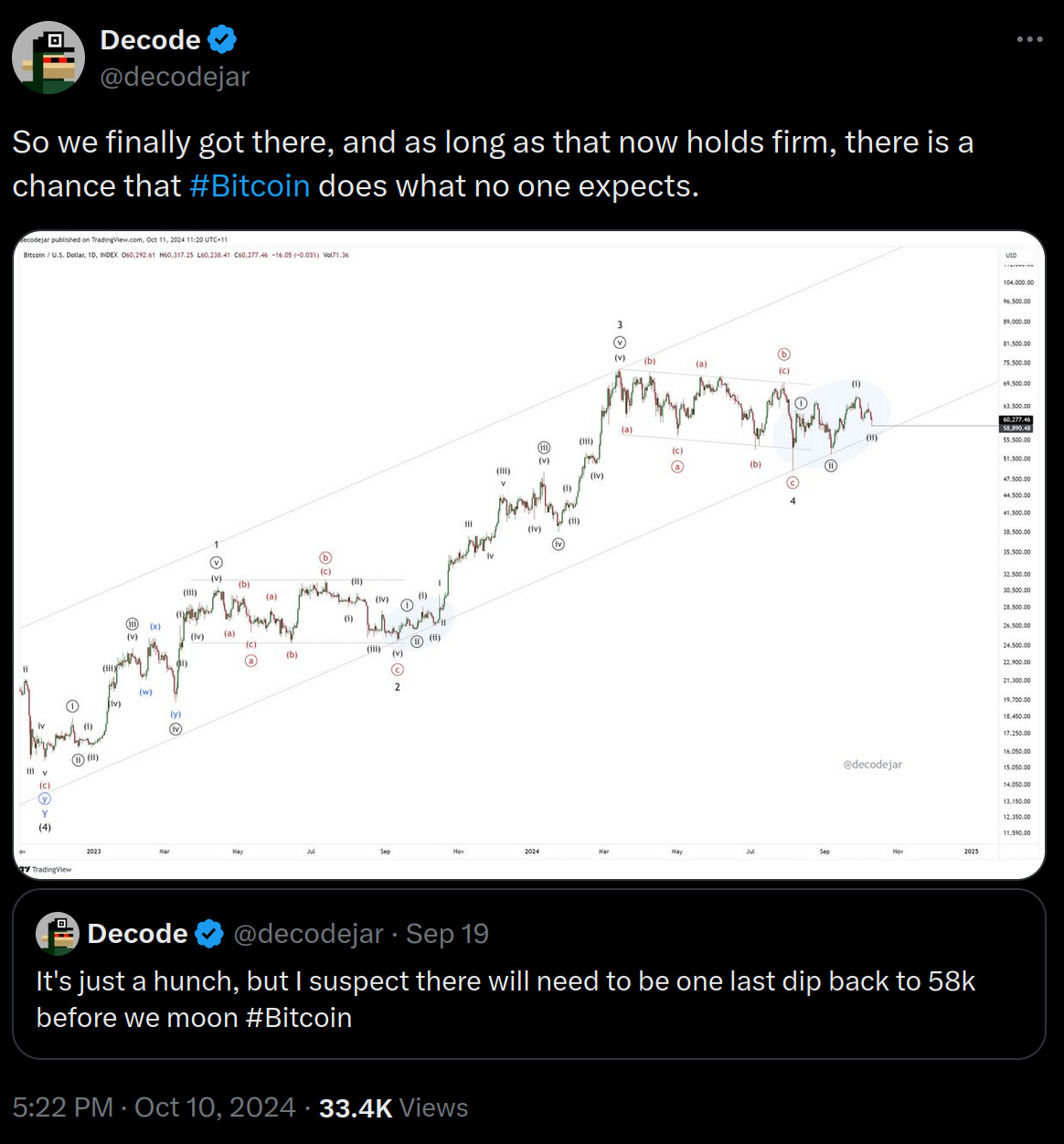

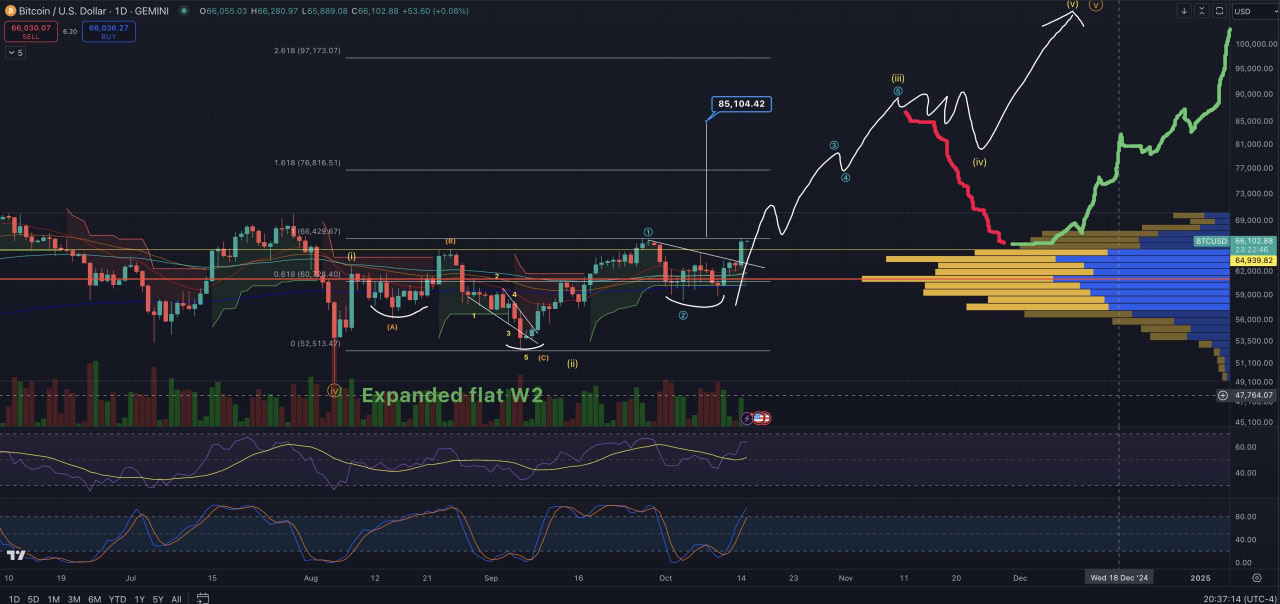

Yet ostensibly, mathematically implausible for Bitcoin to form a Pi Cycle top in Q4 for Camel’s end-of-bull-market expectation (unless Camel is extending it into 2025, c.f. also, also)— would need more time for a run-up to raise the yellow EMA up to the white EMA. And the Pi Cycle ‘short EMAs’ are relatively oriented as they were at the corresponding posited juncture in 2019.

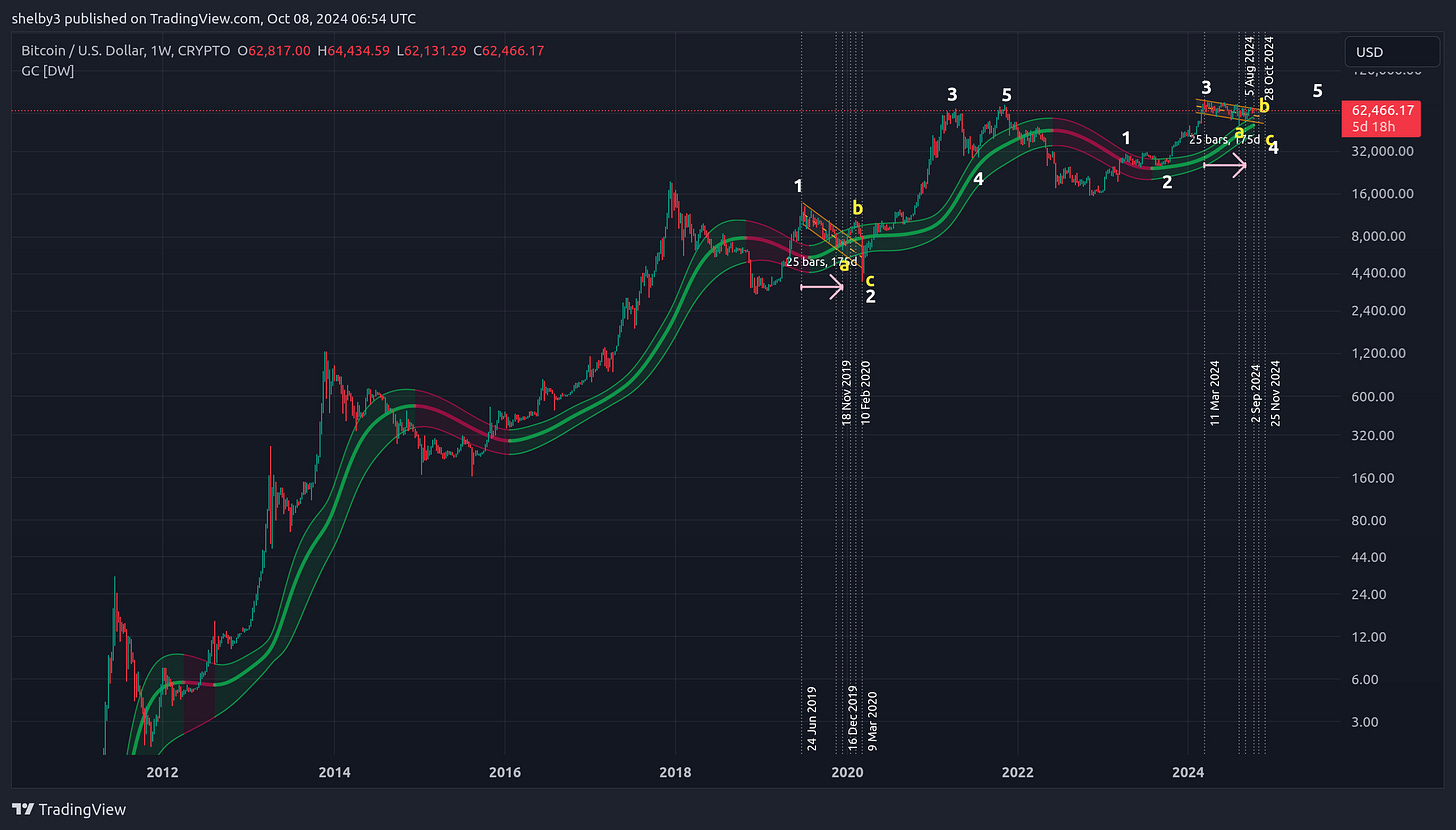

Camel married his correct prediction for a left-translated top, but also that it would be the final top for (at least first major supercycle of) the entire Bitcoin bull market as well as this current (normally four-year cycle) bull season. But I explained and posited that the left-translated top is only for the legacy Bitcoin protocol which had completed three 4-year cycle bull seasons by 2021, given it had been announced/launched 2008/9. Whereas, the impostor, non-legacy protocol soft-fork which currently coexists on the same blockchain (until it’s forced to hard-f-off perhaps in 2028) was not launched until roughly 2014 by Gavin Andresen or not in earnest until the miners signaled for and adopted SegWit in 2017. So my hypothesis is we might/should get both left-and-right-translated tops in this cycle—as Bitcoin sort of did in 2019 and 2020 as well, except it was in Elliot wave 1 in 2019 instead of wave 3 in 2024.

Thus would wave 4 (i.e. later in the cycle and new all-time-high) in 2024 resemble wave 2 (i.e. earlier in the cycle and not quite a new all-time-high) into 2019-20, as the impostor soft-fork of Bitcoin approaches to its (posited) 2028 end (i.e. hard-f**k-off) date?

Steve Courtney’s 5.3 theory also correctly predicted the left-translated top (~74 - 79k) thus far. Would the posited incoming bear trap hit only $79k later this month before a crash below $50k again?

I commented on Camel’s video, Bitcoin Rally & Recession:

This was a level-headed presentation. Yes the ETFs could be the reason for the early ATH, but that does not explain why there was a left-translation in terms of cycles. (

EDIT: you may have a different terminology such as cycle inversion to describe a left-translated acceleration that is not the final top, which is what I am abbreviating as left-translated in this early ATH context.) I explained the reason to you many times, but you ostensibly have not watched my 2 hour video to edumucate yourself. I watch your videos (on double-speed, and damn I need triple speed) to edumucate myself in your areas of knowledge. Legacy Bitcoin is already on its 4th cycle. But the pay-to-script-hash is a totally different Bitcoin, as will be borne out by 2028 when it is kicked off and destroyed. That latter protocol is only on its 3rd cycle. Camel I have secret knowledge in my area of specialization. You should not ignore. Remember secret knowledge looks like gibberish to those who do not specialize in that area. That is why you are ignoring me. I might as well be speaking Klingon.

Steve Courtney posits (as it has done every time in Bitcoin’s history other than the first) that the Gaussian channel acts like quicksand and pulls Bitcoin down into it after any dead cat bounce.

So what might that look like? Here’s an idea. Investors have too much uncertainty for an immediate FOMO breadth expansion? An upwards choppiness would be consistent with such sentiment. A five-wave leading diagonal for major wave 1 (as posited below) is bullish, but the (possibly flash crash into the prospective November 25) wave 2 is a final flush-out bear trap before the break out with wave 3. Note this would be wave 3 in a more major wave 5, given the hypothesis that this sideways-to-down chop since March was major wave 4.

The above idea (narrative) while not certain of course, makes sense. Why would crypto breakout to a new ATH with sustained breadth expansion when there’s so much uncertainty about inflation, war, etc.. Much more logical that the stock market has a flash crash into the November election, which resets the markets for the liquidity cycle that might be in full swing in the new year.

Whereas the other possibility is that it does breakout.

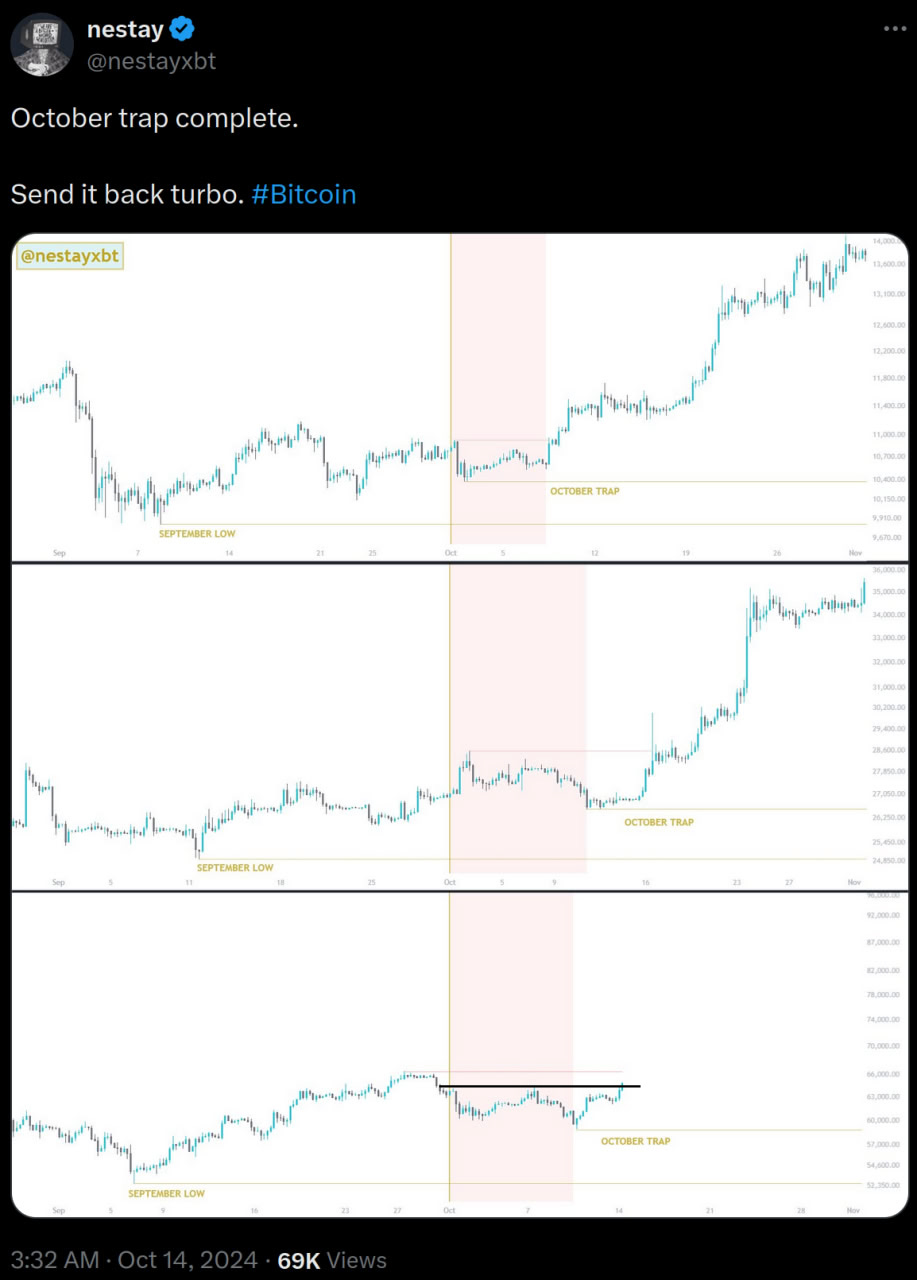

Oct 14 Update: “I’m your boy” Camel postulates that according to cycles theory Bitcoin shouldn’t make a new low until around Nov 5 (plus or minus a few days) and thus Bitcoin must move higher first or a-b-c correct down into the low.

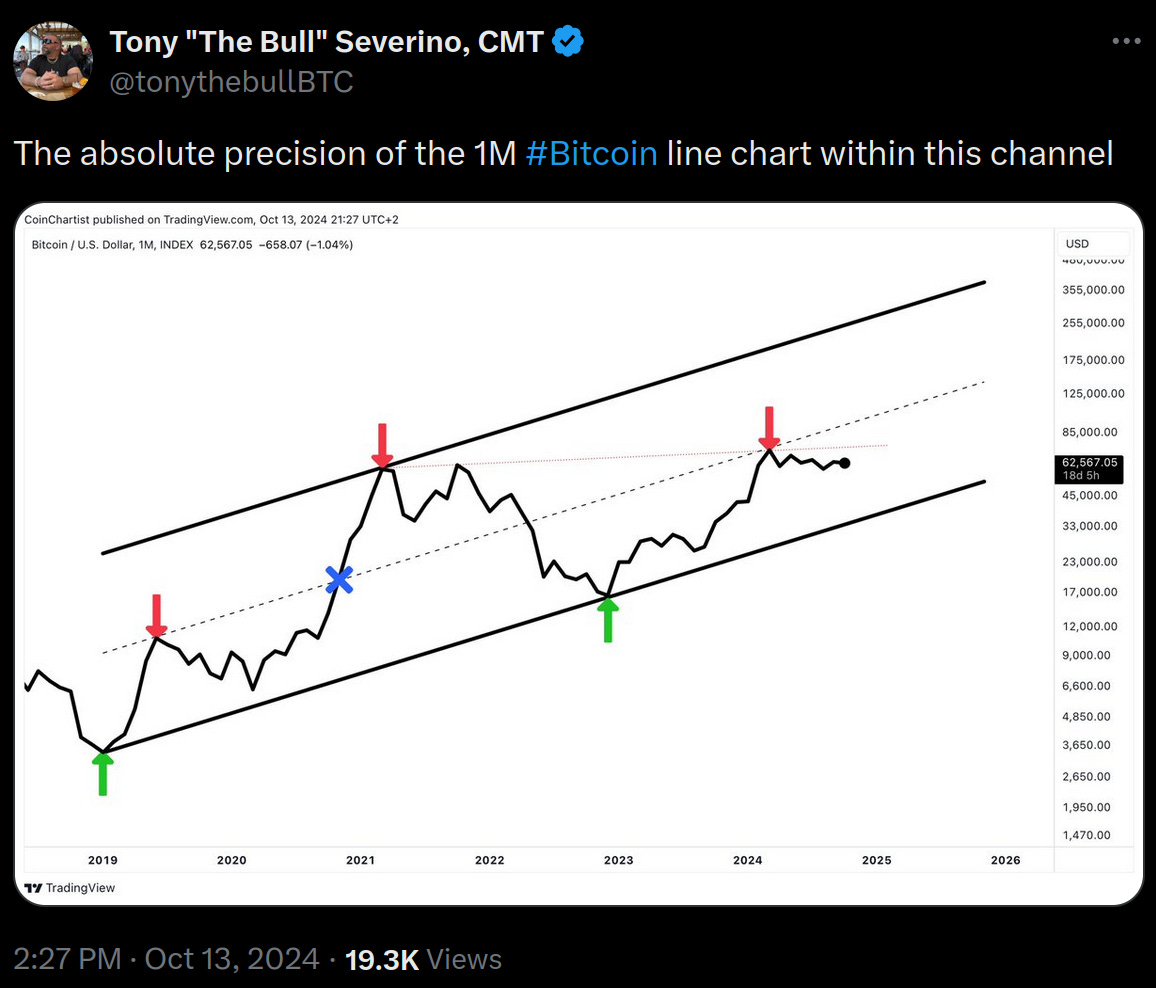

A monthly candles chart helps to visualize that expansion to significantly higher-highs to occur eventually (even if months from now) and wicks to the downside would be short-lived. Either Camel’s expansion imminent or first some more churn.

Alt(ernative)-cons are more bullish than Bitboycorn?

Even Camel who loathes the altcorn casino, speculates that the Russell 2000 is poised to lurch up to 2700— a breadth expansion into the FOMO top presumably based on the “soft landing” narrative, manipulated unemployment and plummeting inflation.

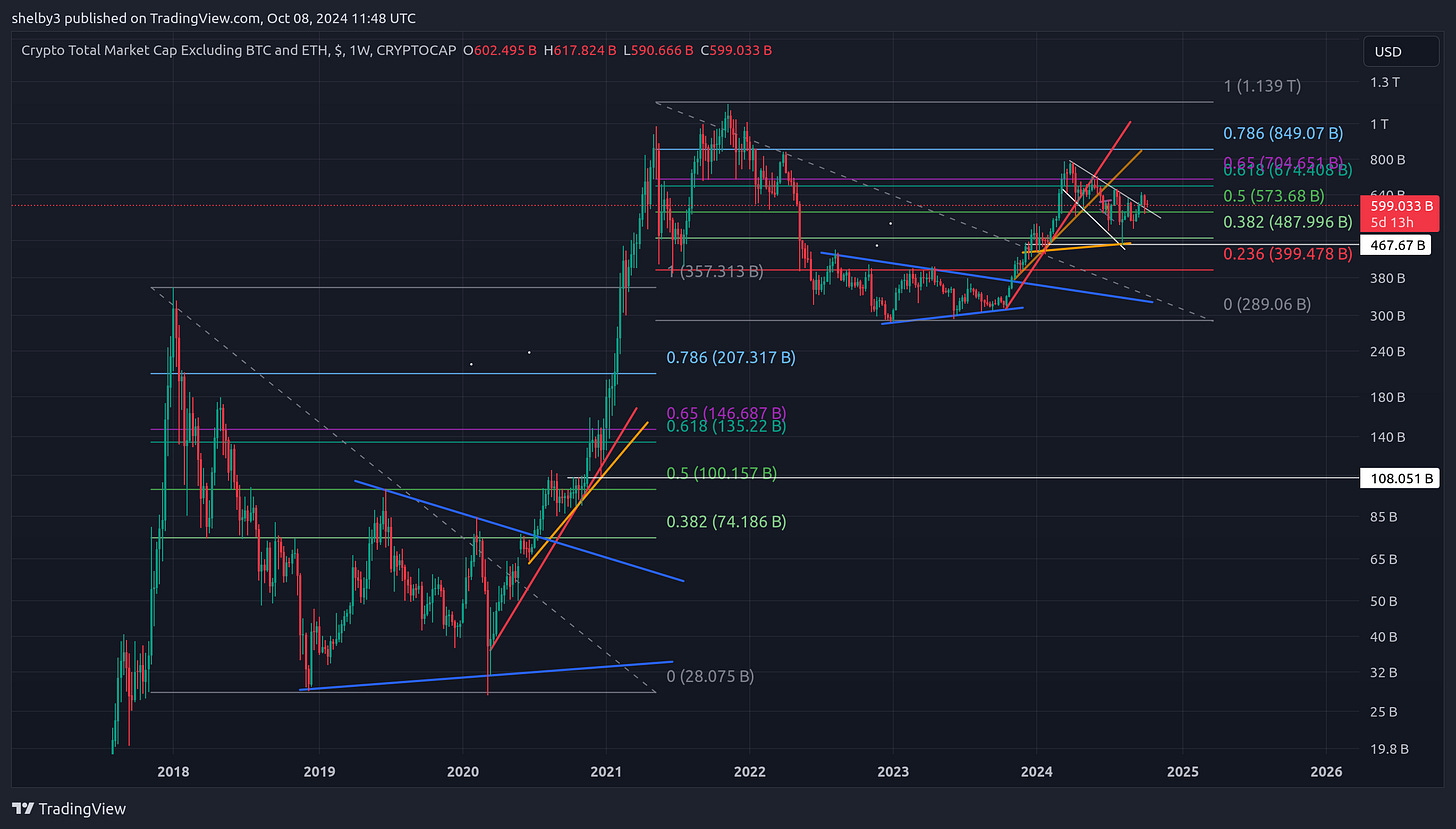

Despite failing our speculation back in May for continuing verticality (as indicated by the failed red and orange annotated lines), TOTAL3 is much more bullish than it was in 2019. Ostensibly (along with Microstrategy, c.f. deets) already broke up out of it’s range ahead of Bitcoin, which hasn’t yet.

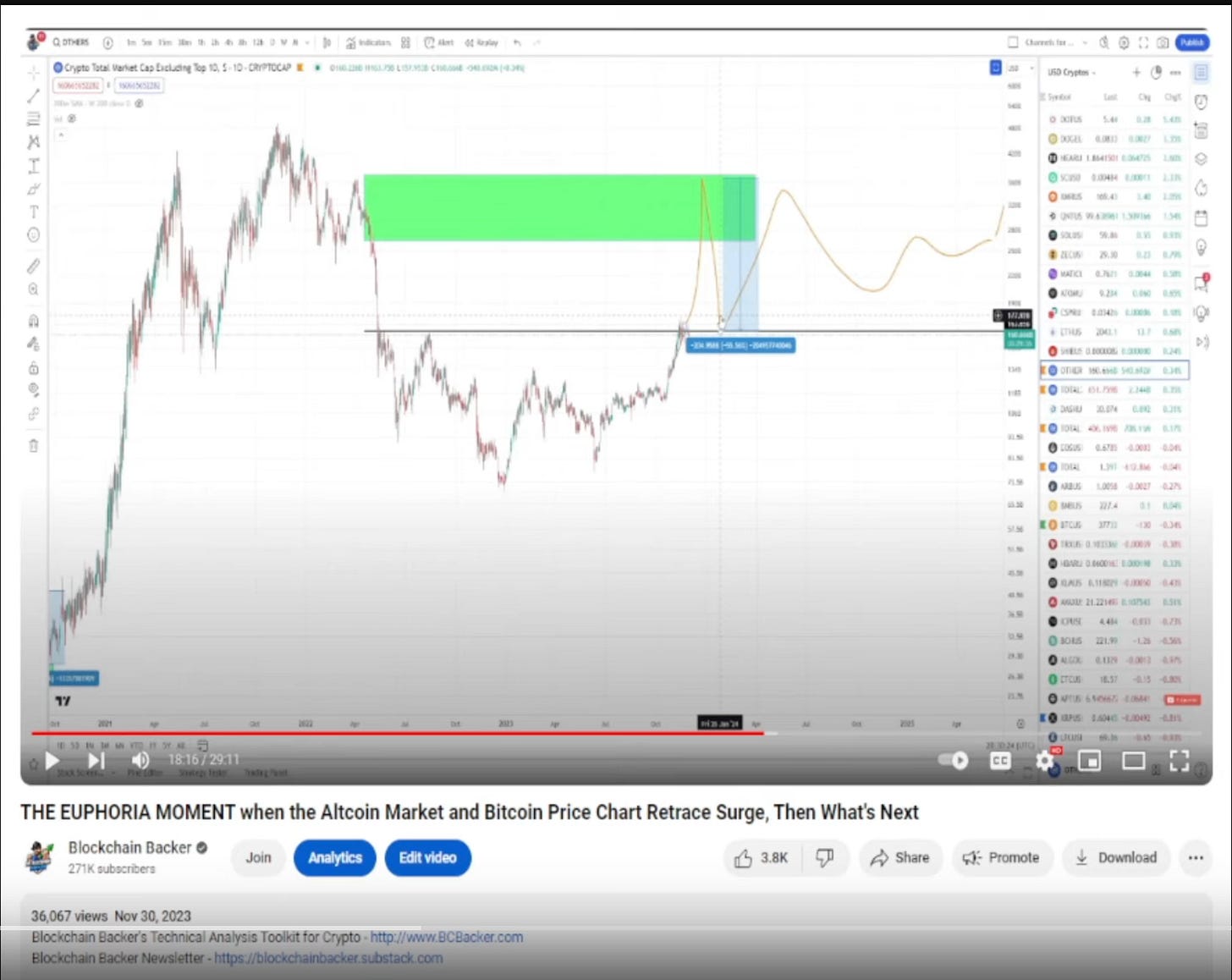

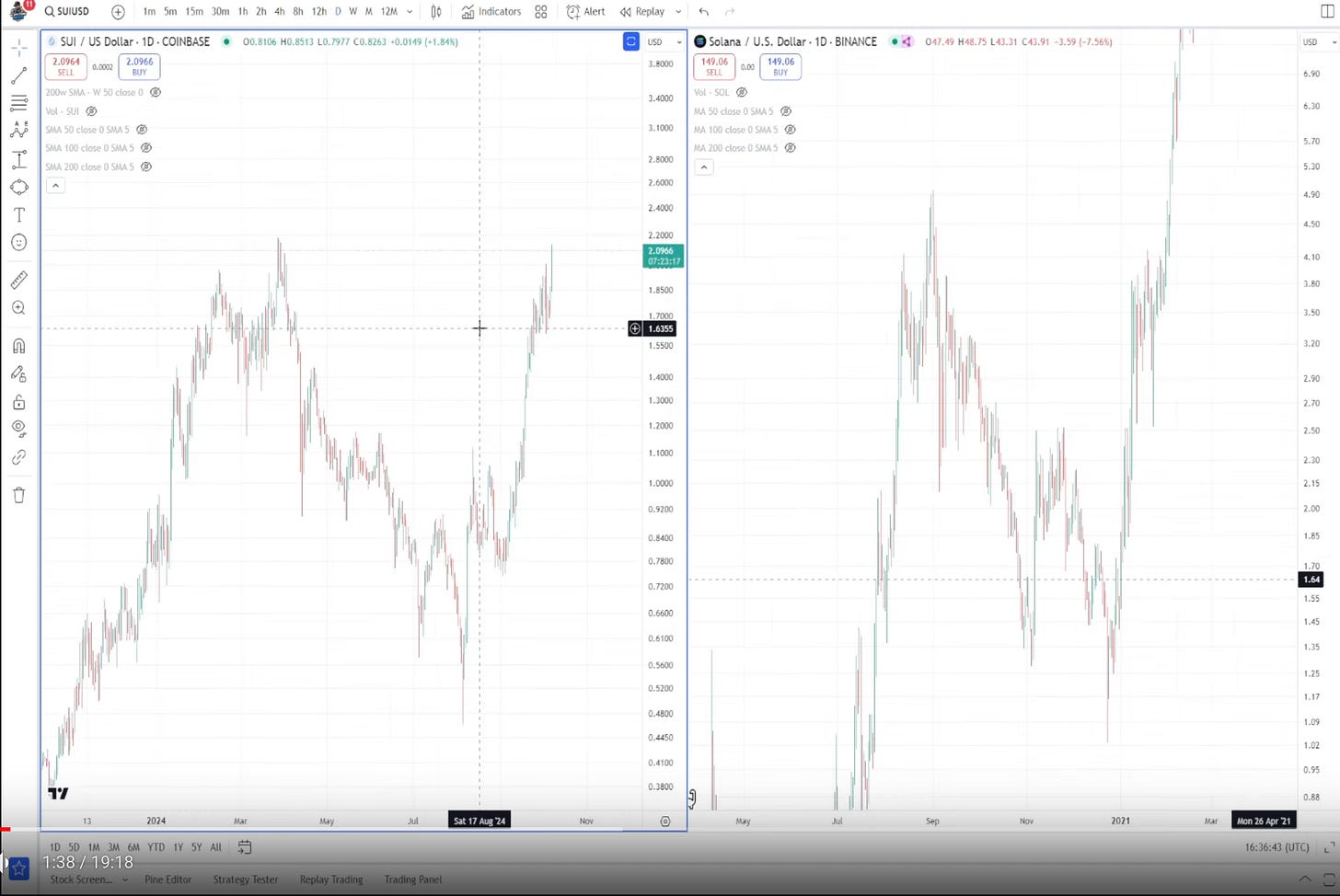

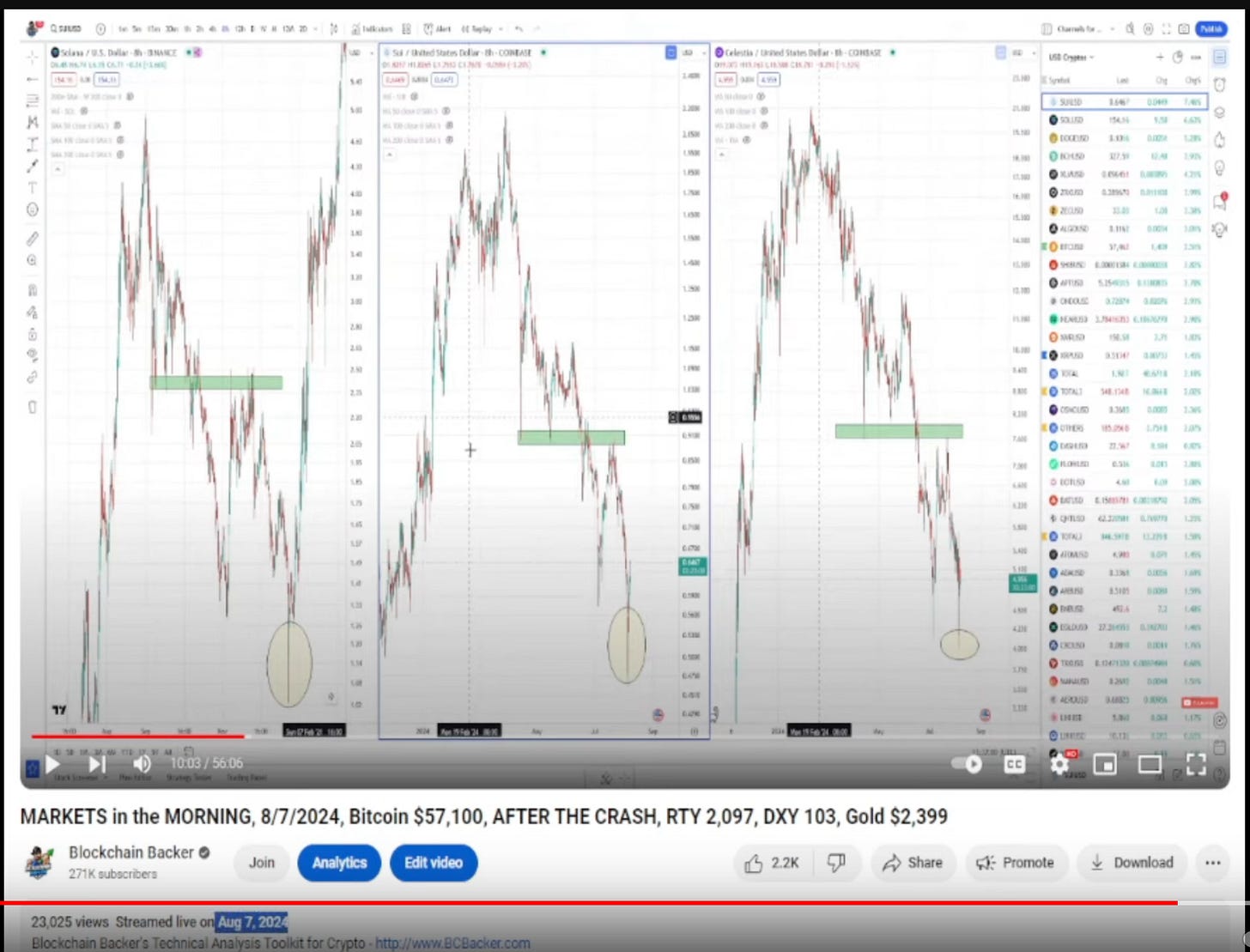

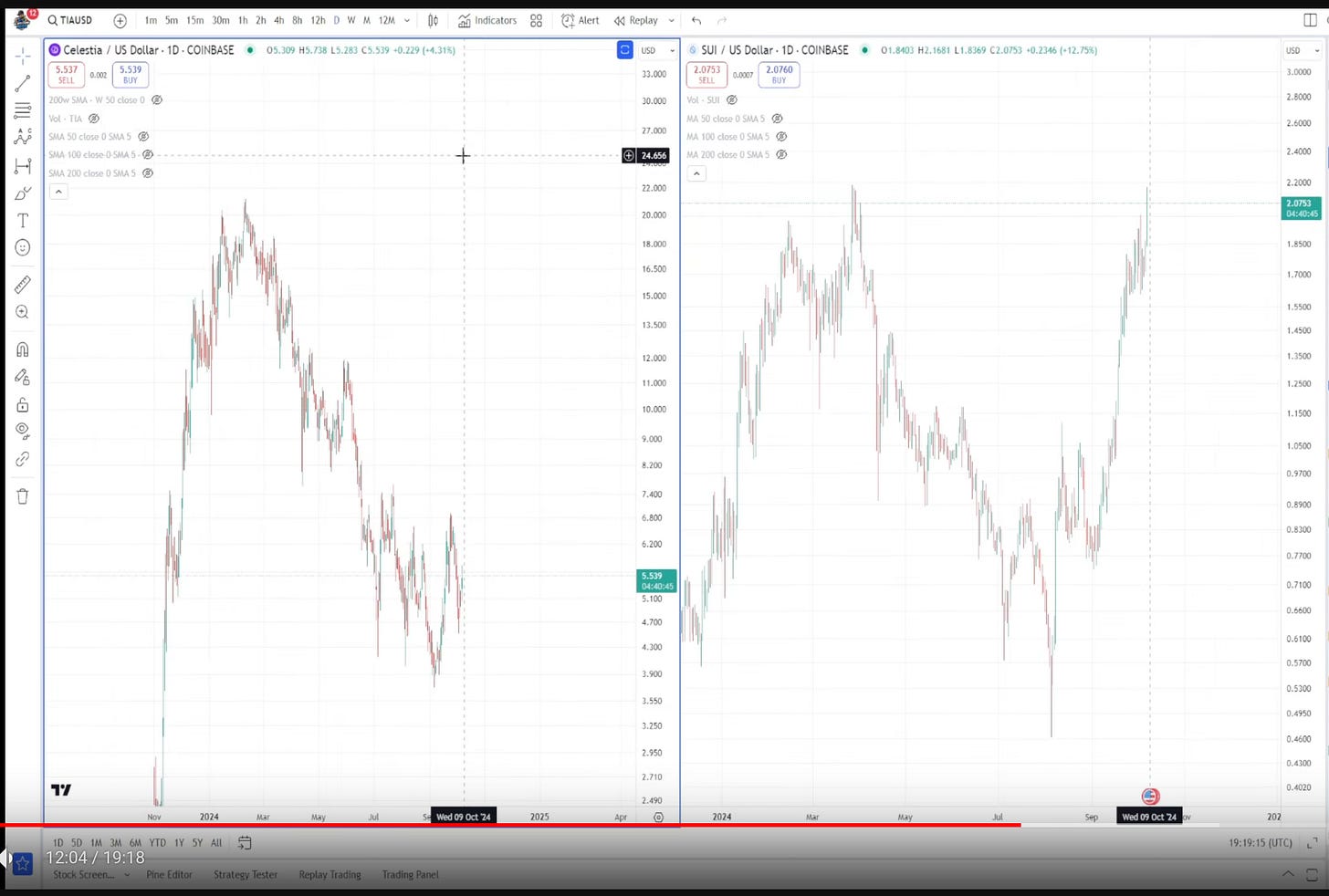

Blockchain Backer who btw predicted the run up from October 2023 to March 2024 and subsequent -58% (up to 80%) retrace, sees more evidence of a firm bottom and resumption of bull market, with for example some 2021-Solana-wanna-be (e.g. SUI) already retracing its entire decline.

And many alts are building bases that seem to resemble a meandering multi-month bull market ahead. Which would be incompatible with Camel’s base case of a final top for this bull market in the next few weeks? So would any Q4 flash crash simply end up being bought up aggressively as the BTFP dip for Bitcoin in 2023, instead of crashing to new lows? Presumably alt-scams would react very favorably to some massive stimulus pour on any recessionary+banking+cyberattack+war+election crisis, as did Bitcoin to the BTFP Fed pivot to stave off numerous bank failures† in 2023. Especially this late into the four-year cycle, which has in the past normally been altcoin season.

Agreed that the fear of repeating the failed breakout rejection of 2020 at such a low price is likely a contrarian indicator. Because if applied to TOTAL3 then it should at least retrace to March highs (c.f. my TOTAL3 chart at start of this section).

More suggested Blockchain Backer content:

POSITIVE…S at the Lows for Altcoin Market w\Breadth, …Recovery Structures

WE'VE SEEN THIS BEFORE, Altcoin Market Structures Like Prior to Past Runs as Bitcoin Price Waddles

Oct 24 update: Bullish that retracing top of range on fearful sentiment

[3] Which little did we know at the time that “Gill Bates” was already planning in October 2019 with Event 201—ostensibly to prevent Melinda from taking her half-or-more of the martial assets in a divorce settlement?🤦♂️

Does this look firebombed? 😲🤔🤨